submitted by jwithrow.

Journal of a Wayward Philosopher

The Cultural Shift Away from Parasitic Society

January 22, 2015

Hot Springs, VA

The S&P opened at $2,034 today. Gold is up to $1,296 per ounce. Oil is floating around $46 per barrel. Bitcoin has climbed slightly to $233 per BTC, and the 10-year Treasury rate opened at 1.94% today.

The big news today is the quantitative easing announcement from the European Central Bank. The global madness continues! The ECB will create 60 billion euros every month to buy sovereign European bonds with September 2016 being the target end date.

As we have seen, first in Japan and then in the U.S., once a central bank sets forth to monetize sovereign debt there is no turning back. Japan now plans to buy Japanese equities in addition to government debt. Prime Minister Shinzo Abe is even discussing a plan to print yen and buy every Japanese citizen a gift card! The U.S. embarked on QE1, then QE2, then QE3, and I fully expect QE4 to come by early 2016 at the latest, quite possibly sooner. All of these liquidity programs have caused major distortions and malinvestments in the economy.

Last week we pulled the curtain back and examined how the Fed has artificially propped up the economy with exponential credit expansion and we realized the house of cards will fall when the credit expansion stops. We also discussed some strategies to insulate your portfolio from the coming financial destruction.

We are particularly scornful of the Fed and its policies because most of the economic problems we now face could not exist if it weren’t for the adoption of central banking. It is important to point out, however, the deformation of capitalism and free markets is a much broader issue that is not the result of one or two bad policies thus the problems cannot be fixed with a few simple tweaks. Ultimately, it was a gradual cultural shift that enabled the growth of governments and central banks, parasitic institutions all, and it is a cultural shift that must once again occur before present-day problems can be solved.

This sounds like such a strange thing to say primarily because our school textbooks do not promote an understanding of real history. Instead, the textbooks present current culture and institutions as the inevitable end of history – our way is the best way! With this belief (hurray for our side!) instilled within them at an early age, people are later unable to emotionally detach themselves from large cultural systems even when they know the systems have become corrupt. The corruption is associated with a single individual or group rather than the underlying systems; it’s always the fault of a particular president or political party so people endlessly think the solution is to throw out the bums and elect better leaders. This dynamic has played out all through history just as it is playing out within our current civilization.

The cultural shift in America ramped up at the dawn of the 20th century as Americans increasingly shifted away from market-based societies and towards top-down authoritarianism. This cultural shift fueled the disease of politics to the point where everything is politicized today. Here’s a brief timeline to map this cultural shift:

1913: The Federal Reserve System is established, the Sixteenth Amendment creates the income tax, the Seventeenth Amendment eliminates a major check on federal power by transferring the election of Senators away from state legislatures and to the general populace.

1918: All states have passed compulsory school attendance laws giving rise to the public school system.

1933-1938: The New Deal launches both the welfare state and the regulatory state with an avalanche of federal programs, President Roosevelt confiscates and criminalizes private gold ownership in America.

1944: The Bretton Woods Agreement officially puts an end to the international gold standard.

1950: The Korean War launches the warfare state.

1955: The Vietnam War institutionalizes the warfare state and marks the rise of the military-industrial complex which made perpetual war an extremely profitable enterprise for defense contractors.

1964: The Great Society expands the welfare state tremendously by launching even bolder federal programs to fight the “War on Poverty”, silver is demonetized and removed from U.S. coinage.

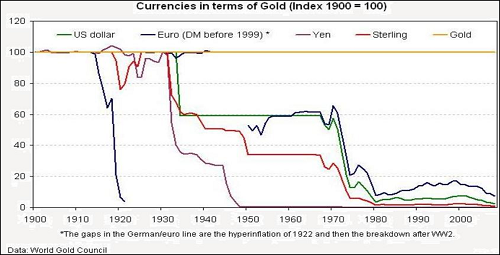

1971: President Nixon unilaterally ends the U.S. dollar’s convertibility to gold thus ending the Bretton Woods System and giving rise to a 100% fiat monetary system.

1981: President Reagan announces the “War on Drugs” paving the way for police militarization all across the U.S.

2001: President Bush announces the “War on Terror” leading to the escalation of foreign military interventions, The PATRIOT Act is passed authorizing the destruction of American privacy and civil liberties and launching the domestic surveillance police state.

2008: T.A.R.P. is passed authorizing the federal government to bailout Wall Street with taxpayer funds, The Federal Reserve launches its first quantitative easing (QE) program designed to purchase Treasury bonds from the federal government and mortgage-backed securities from Wall Street using newly created currency.

2010: The Patient Protection and Affordable Care Act is passed effectively cartelizing the already corrupt health care industry in the U.S. with an onslaught of mandates, subsidies, databases, and centralized federal interventions that will undoubtedly lead to reduced quality and skyrocketing prices in the health care industry.

There are certainly gaps and omissions in this timeline but it does illustrate the cultural shift over the past century.

Every one of these bullet points increased the size, scope, and power of existing power-institutions – the U.S. Government, the Federal Reserve, Wall Street, U.S. Intelligence Agencies, Defense Contractors, Police Forces, Public Schools and Universities, Insurance Companies, and a whole host of smaller institutions that benefit from increased centralization, taxation, and regulation. All of these items reinforce the idea that politics should be used as a piecemeal solution to any problem (or perceived problem) that exists. Likewise, these items reinforce the idea that political action is the only solution available to those who do not agree with the political mandates imposed upon them. All of these items serve to transfer power and sovereignty away from individuals, families, and communities to politically connected monolithic institutions.

The corporate media perpetuates this transfer of power from individuals to institutions by conditioning the public to emotionally identify with one or the other political party. Once emotionally attached to a political party people are easily convinced by the same corporate media that the other political party is the enemy. If our team can beat their team in the next election then everything will be fine. This locks people into a perpetual short-term mindset as if the next election is the most important election in history. They forget that they have been participating in the election process for decades only to see political and economic problems grow much larger over the same time period. Even worse, the media perpetuated left-right paradigm turns neighbors against one another over irrelevant issues thus distracting them from the major problems (and solutions) of our time.

It is easy for us to point fingers at the power-institutions but we must also understand that they only exist because we legitimize them.

Fortunately the necessary cultural shift away from parasitic politics and institutionalized authoritarianism is already in motion. The shift is still in its infancy and it is particularly quiet due to the aggressiveness of the power-institutions currently in existence. For this reason the shift is only visible to those who are actively looking for it. But the cultural shift towards free markets and non-coercion will become much more apparent over time as the 20th century political world continues to collapse under the weight of corruption and injustice…

Until the morrow,

Joe Withrow

Wayward Philosopher

For more of Joe’s thoughts on the “Great Reset” and the paradigm shift underway please read “The Individual is Rising” which is available at http://www.theindividualisrising.com/. The book is also available on Amazon in both paperback and Kindle editions.