submitted by jwithrow.

Journal of a Wayward Philosopher

Real Money

December 4, 2014

Hot Springs, VA

The S&P is buzzing around $2,069, gold is back up over $1,210, oil is checking in just under $67 after OPEC announced that they would not cut production, bitcoin is hanging around $373, and the 10-year Treasury rate is checking in at 2.29% today.

How about those prices at the pump, huh? Some resource analysts think that oil won’t remain this low for long. They point to the fact that several OPEC nations are dependent upon high oil prices to run their social welfare states and suggest that, coupled with increased demand over the coming winter, oil will be forced to climb back up the ladder. Other analysts suggest there are numerous oil companies still profitable at current price levels thus supply will remain strong and oil will hang around current prices for longer than expected.

We can’t know which analysts are right and which are wrong but we do know that numerous well-run resource companies have seen their stock price hammered as a result of oil’s decline while the S&P has continued to escalate up its stairway to heaven. Speculators may see this as the best opportunity to get into resource stocks since 2009. Natural resource prices are especially cyclical – low prices drive marginal producers out of business which reduces supply and leads to higher prices which attract marginal producers back to the industry. Booms lead to busts which lead back to booms. Those disciplined enough to buy the bust and sell the boom tend to do well in the resource sector.

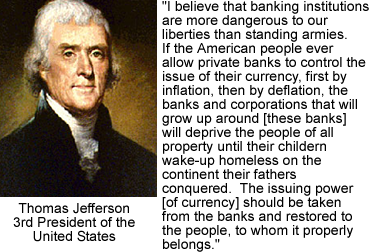

Speaking of natural resources, it is the rejection of real money backed by precious metals that, more than anything, has led to the disturbing macroeconomic trends we have been analyzing recently.

In October we examined fiat money and realized that it has always been a major drain on society when implemented throughout history. We agreed fiat money is any currency that derives its value from government law and regulation and we noted that legal tender laws are what force the public to use the government’s money rather than the market’s money.

The academic economists would have you believe we have a complex and sophisticated monetary system. They would suggest that you cannot possibly understand it so you may as well leave it to the experts. The economists will use strange terminology when discussing the economy in newspapers and on television in order to confuse and bore you. Want to know their little secret?

Our economy operates mostly on fake money.

I know, it sounds ridiculous. How is it fake money if you can spend it? That’s exactly what makes the fake money so insidious – you can’t tell that it’s counterfeit.

I will attempt to explain myself by asking a simple question: where does our money come from?

Take your time, I will wait…

If you said “from thin air” then you are the winner! For the last forty years or so our money has been loaned into existence. The Federal Reserve loans new money to its member banks and to the U.S. Treasury and the new money then eventually finds its way into the general economy. Where did the Fed get this money to lend? It created it! From nothing. Ex nihilo nihil fit.

But wait, it gets better. This same process takes place every single time a bank originates a new loan. Say you go get a mortgage to purchase a new home. The bank supposedly lends its deposits to you at interest to finance your home. But this isn’t entirely true. First, the bank is only required to have a fraction of the loan in reserve – roughly 10%. So if your mortgage is $100,000 the bank is required to have at least $10,000 in deposits to support the loan. But does the bank actually take that $10,000 and give it to you? Of course not! That $10,000 in deposits stays right where it is. It could be spent tomorrow if the depositors took a trip to Vegas. So where does the money come from to finance your home?

Hint: it’s the same answer as above.

So you get $100,000 in fresh new money and give it to the seller in exchange for the house. The seller uses your new money to pay off his mortgage and often there is a little bit leftover. The seller calls this profit and puts it in his account and the economy’s money pool gets a little bit bigger: there is now more money in the system then there was before you financed your house.

The economists use terms like ‘M1’, ‘M2’, and ‘money multiplier’ to make this seem like a complicated system but as you can see it’s pretty simple. It’s just a journal entry and a few clicks of the mouse and… PRESTO!

No one noticed a little extra money sneaking into the system here and there at first. But the rate at which new money entered the system increased dramatically as the money supply grew. Forty years later we are starting to see the ill-effects of exponentially expanding credit-based money. This credit expansion has distorted all aspects of the economy because money is half of every transaction. Financial planning and analysis is extremely difficult if no one knows what one unit of money will be worth from one year to the next. It’s always apples to oranges.

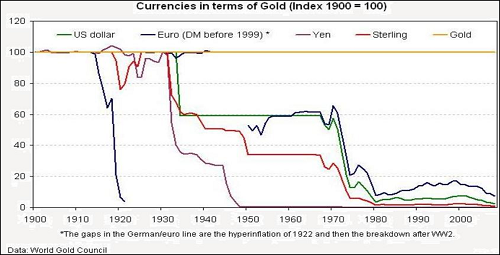

So where did our money come from before the fiat money explosion? Money has taken on many different shapes and sizes throughout history but if you go back just a little bit in modern history, say to the mid-19th century, you will probably find yourself using the market’s choice for real money – gold and silver. A little bit later – the late 19th century or so – governments muscled their way into the money business and, instead of just minting gold and silver coins, they created national currencies but they fully backed these currencies with gold or silver. While fully convertible, the currencies operated much like real money but it didn’t take long for governments to reduce the real money backing. They found this so pleasant, they eventually got rid of all currency ties to real money altogether!

One of the big advantages to using real money is that it tends to maintain purchasing power over long periods of time. You can expect real money today to be roughly as valuable as real money ten years from today. You could actually save this real money if you wanted to! Saving leads to capital formation which can drive steady economic activity without the need for massive credit expansion which always results in booms and busts.

There are numerous other advantages to using real money but wife Rachel will fuss at me for making this post long and boring as it is so we will have to come back to them in a later entry.

More to come,

Joe Withrow

Wayward Philosopher

For more of Joe’s thoughts on monetary history and real money please read “The Individual is Rising” which is available at http://www.theindividualisrising.com. The book is also available on Amazon in both paperback and Kindle editions.