submitted by jwithrow.

Journal of a Wayward Philosopher

How I Escaped the Rat-Race

May 28, 2015

Hot Springs, VA

The S&P closed out Wednesday at $2,123 – almost exactly where it was at the same time last week. Gold closed at $1,186 per ounce yesterday. Oil checked out at $57 per barrel. The 10-year Treasury rate closed at 2.13%, and bitcoin is trading around $238 per BTC.

Dear Journal,

We are back in the serene mountains of Virginia after a week spent on the gorgeous Carolina coast. Madison’s first beach trip was a success and we enjoyed five consecutive days of low 80’s with a cool breeze. Your editor even squeezed in a half-day fishing trip towards the end of the week after building up Dad points by handling Maddie’s late morning nap time indoors for the first several days so Momma could lay in the sand.

Last week I shared with you my view of the coming monetary crisis and I promised to expand upon what I have done to prepare for it and how I managed to escape the rat-race in the process.

Career is often one of the first items up for discussion when catching up with friends. You know the process: “What are you doing now? How’s that going? Do you like it?”

I find that very few friends tell me they like their job. Most say it is okay or tolerable. Some say they are miserable for one reason or another. Even the ones who say their job is tolerable express a certain sense of anxiety on Sunday afternoons as they look forward to the grind starting back up for another week.

Despite this, most people become addicted to their paycheck because they fashion their lifestyle accordingly. A couple things tend to happen when the paycheck gets bigger: the house gets bigger, the car gets nicer, and the hobbies become a little more luxurious. The problem is many of these things come with monthly payments. The big house comes with a big mortgage and strong HOA dues. The nice car comes with a big car payment and probably a satellite radio subscription. The luxury hobbies might include membership fees of various kinds: country clubs, golf courses, dinner clubs, mega-gyms, etc.

Now there is nothing wrong with any of this unless your goal is to escape the rat-race. If so, you need your paycheck to maximize capital rather than support your lifestyle. The following is the abbreviated version of how I went about maximizing capital so I could leave the rat-race in the dust.

My first step was mental: I crafted a vision of living outside the rat-race as I became more disillusioned with corporate America. I had been working in the corporate banking world for several years by this point and I had worked my way up to a comfortable salary relative to my circumstances. I was contributing the standard 3% match rate to my 401(k) and I was maxing out my self-driven IRA each year as I had been educated to do so I had a decent financial cushion to start with.

I created a spreadsheet to track my monthly expenses and pretty soon I was able to trim the fat and start saving 75% of my net income each month. I didn’t become cheap for its own sake – I still took my fiancé (now wife) out to dinner every Friday – but I did stop all frivolous spending. Though I couldn’t see far enough ahead to envision my day of liberation, I did know that I would be able to break the employment chains in the near future if I amassed a decent pool of working capital.

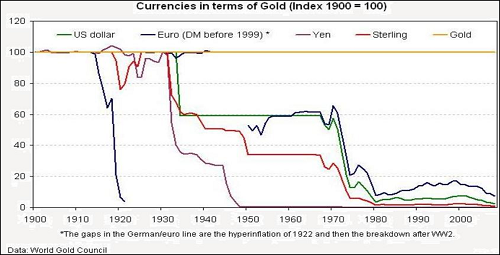

As my knowledge of Austrian economics grew, so did my appreciation for the precious metals. I began to make periodic trips to the local coin shop to redirect some of my monthly savings into gold and silver bullion. I didn’t originally have an asset allocation model in place so my purchases were somewhat sporadic but I did accumulate a (relatively speaking) decent precious metals base over the course of a year.

Austrian economics also helped me see how the housing bubble was being partially re-inflated by the Fed’s quantitative easing (QE) and zero interest rate policy (ZIRP). Private equity firms like Blackstone and American Homes 4 Rent (AH4R) were taking advantage of this easy money to buy up huge quantities of single family homes in the U.S. to build their rental real estate portfolios. These private equity companies were taking the Fed’s cheap credit at near-zero rates to buy middle class homes which they rented back out to the middle class with a huge profit margin built in. Now there is nothing wrong with reaping huge profits as long as they are honestly gained but there is a major problem with a system that distorts the market economy in favor of special interest groups.

I was bothered by what was going on in the housing market but I also understood that I was powerless to change it. Therefore I did the next best thing – I took advantage of the situation and sold my home to AH4R for a sizable gain. Some of that gain went to pay the real estate agent’s commission and I rolled the rest into a down payment on a 5-acre rural property at the end of a gravel road way up in the mountains which is where I reside today.

My goal for our mountain home was to make it as resilient as possible such that we could be totally self-sufficient for at least six months should hard times befall us. I don’t have room in this entry to go into the specifics, but we accomplished this by securing surplus water, food, provisions, and energy sources. The end result is that I am confident in my household’s ability to be self-sufficient for at least six months should the need arise which means our livelihood is not solely dependent upon consistent monthly income. The cost to maintain this self-sufficiency is pretty negligible after the initial purchases are made.

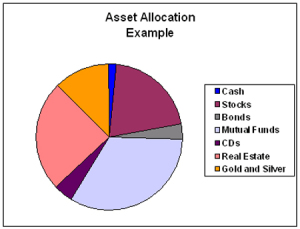

It took me roughly six months to complete these base self-sufficiency preparations and then it was time to hone in on my finances. I set up a spreadsheet to monitor my asset allocation model and I established the initial allocation ratios: 29.5% cash, 10% precious metals, 15% stocks, 0.5% bitcoin, and 45% real estate.

I was already in excess of my cash and real estate allocation because of my 75% savings habit and my 20% down payment on our 5-acre property so I used the excess cash outside of my IBC policy to bring the precious metals, stocks, and bitcoin allocations up to par.

All the while I was researching how to build location-independent income streams online in my spare time. There are more entrepreneurial opportunities today than ever before in modern history. Thanks to the internet anyone can reach millions of prospective customers with just the click of a button and there are very few barriers to entry. This means all you need to be an entrepreneur is a product that provides value to people in some capacity and a basic understanding of online marketing techniques. It requires very little capital to launch these types of products. More importantly, you can launch these products without needing to obtain permission from the government first in the form of certifications and licenses. In comparison, try to start a traditional brick & mortar business without government permission and see how that experience goes.

So to recap:

• I invested in my own education first by developing a strong understanding of Austrian free market economics.

• I purchased a rural 5 acre property with advantageous financing.

• I made ample water, food, energy, and provision preparations so as to be self-sufficient on this property for at least six months should the need arise.

• I shored up my asset allocation model to spread my capital across several asset classes: cash, precious metals, stocks, bitcoin, and real estate.

• I began to build location-independent income streams online.

I have an entire chapter dedicated to the specifics involved in this process in the 2nd edition of The Individual is Rising which I hope to launch later this summer. I will keep you posted as that progresses.

I will sum up this entry by repeating a common theme here at Zenconomics: life is meant to be lived.

It is up to you to make your life exciting and meaningful – no one else will do it for you. This requires a break from Modernity which emphasizes a fear & control mindset intended to put life in a box and stomp out any potential randomness before it happens. We are all conditioned to live within Modernity’s box so it is difficult to step outside and blaze your own path. But your life may depend on doing just that.

More to come,

Joe Withrow

Wayward Philosopher

For more of Joe’s thoughts on the “Great Reset” and creating diversified income streams please read “The Individual is Rising: 2nd addition” which will be available later this year. Please sign up for the notifications mailing list at http://www.theindividualisrising.com/.