submitted by jwithrow.

Asset allocation is a necessary tool for saving money and building capital within a fiat monetary system. Within a fiat system, the purchasing power of your currency is gradually inflated away and the value of various asset classes can fluctuate rapidly based on central bank monetary policy. Thus, it is important to have a principled yet flexible asset allocation model in place.

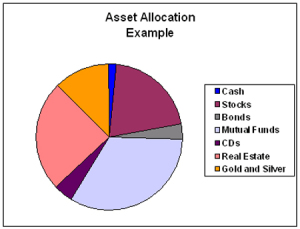

The concept of asset allocation is to allot a percentage of your capital to various asset classes and to maintain each allocation ratio until you deem it necessary to adjust your model. For example, a basic asset allocation model could consist of 25% cash, 25% precious metals, 25% real estate, and 25% stocks. You would then allocate your income to each asset class accordingly.

The beauty of this strategy is that you cannot be wiped out by any wild swings in the market and you will always have cash on hand with which to purchase assets when they go on sale (when the market tanks). Of course you can always add additional asset classes into your model such as bonds or bitcoin or cattle depending upon your outlook and you may need to adjust your percentages based on new analysis from time to time as well.

The Infinite Banking insurance strategy that we talk so much about here at Zenconomics and in our book works perfectly to house much of your cash allocation. An IBC policy serves to compound returns on your cash while it sits idle waiting to be put to use without sacrificing any liquidity whatsoever.

As for your precious metals allocation, you can purchase gold and silver bullion from any local coin shop or from reputable dealers online or you can purchase through companies like Hard Assets Alliance which will facilitate fully allocated domestic or international storage for you.

Of course to follow an asset allocation model you will need to save a large percentage of your income. I think 50% is a good benchmark. 75% savings is preferred. Very few people have the discipline to pull this off but those who do never have to worry about financial problems again.

If maintaining such an asset allocation model for your household sounds extremely tedious and time-consuming that’s because it is. This is the price we must pay for living under a fiat monetary regime. In a sound monetary system we would be able to build capital simply by saving money in a bank account because our money would maintain its purchasing power over time. Instead, saving money in a bank account is a losing strategy so we are all forced to become financial analysts or have our wealth systematically transferred away from us.