submitted by jwithrow.

Yesterday we examined the merits of the Infinite Banking Concept. Today let’s look at some IBC strategies to build capital and mitigate inflation.

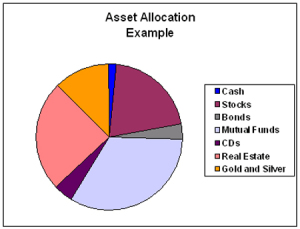

If you combine the Infinite Banking Concept with a fundamental asset allocation model you have the makings of your own personal central bank. If one were so inclined, just like a central bank, one could establish tangible reserve requirements and use the policy’s ever-growing capital base to purchase tangible assets. Your job as Chairman would be to continuously acquire assets based on your allocation model as your central bank’s capital base grew in size to maintain your specified reserve ratios.

The possibilities with this strategy are endless!

The hardest part of employing the Infinite Banking Concept is being patient enough to capitalize your policy over the first several years until the policy becomes self-sustaining.

Imagine a world in which more people take control over their financial destiny by using the Infinite Banking Concept as an integral part of their financial plan. This strategy has the power to mitigate the boom-bust cycles created by the Federal Reserve and the fractional-reserve banks because people employing the IBC strategy would not have much need for traditional bank financing.

The power of the Infinite Banking Concept can truly be unlocked if families were to implement this strategy generationally. For example: what if parents were to set up IBC policies for their children as soon as they were born?

The IBC policy would have the opportunity to grow for twenty years or more, and the next generation would automatically have a large pool of capital available to them upon their maturation into adult-hood. This pool of capital could be used to finance specialized education or to start a business with no student or bank loan necessary.

The child would also receive a substantial death benefit payment down the road when the parents were to pass on from this world. That death benefit could then be used to set up larger IBC policies for future generations so the family’s pool of capital would continuously grow over subsequent generations. Every single one of your children and grandchildren would have access to a significant pool of capital to help them build self-sufficiency and resiliency.

Talk about an individual revolution!

A generational implementation of IBC in this way could gradually transfer the power of the purse away from governments, central banks, and Wall Street and back into the hands of individuals where it belongs. This would cause the financial sector to shrink tremendously, which would free up capital for more productive purposes across the board.

You see, the financial sector doesn’t really produce much of anything. It is more like the money changers of old in that the financial sector does little more than temporarily warehouse capital and then move it around, siphoning off small fees at every stop along the way. The financial sector certainly plays a very important role in a developed economy, but that role should be much smaller than what it is today.

So how do we know that the IBC strategy will survive the Great Reset? The answer is that we don’t know anything for sure.

But life insurance companies have a built-in inflation hedge as they can charge higher premiums to new customers on an ongoing basis as the currency loses value. Additionally, if the currency were to completely collapse, it is highly likely that life insurance companies would re-value their policies in terms of a new currency or maybe gold (we should be so lucky). Also, if you operate your personal central bank wisely and use your capital to purchase precious metals and other real assets, then you have a currency hedging strategy already in place.

Hopefully this chapter has done the Infinite Banking Concept justice, and you can see why we think it is a powerful tool for individuals disciplined enough to devote the time and resources necessary to capitalize a policy.