submitted by jwithrow.

Journal of a Wayward Philosopher

How Fiat Money Enslaves Society

January 1, 2015

Hot Springs, VA

Happy New Year!

The markets stayed in bed today nursing their hangovers so we have no updates for you. Check back with us tomorrow for market updates.

We have recently been discussing the difference between fiat money and real money so I thought it would be prudent to kick off 2015 by discussing how fiat money enslaves society.

I know, nobody is walking around in shackles and chains – the slavery is much more subtle than that. But I firmly believe this is the single most important issue of our time. You cannot understand finance and economics unless you understand how fiat money operates. And you cannot become financially independent unless you understand finance and economics.

So here’s how it works:

Government creates a currency and decrees it money. Being the narcissist institution that it is, Government usually prints faces of past government officials on the physical currency. Next Government creates a central bank and declares that the central bank will issue and manage the currency. Government then implements an income tax to supplement the other taxes in existence and decrees that all taxes must be paid with the government’s currency. Government then passes legal tender laws requiring citizens to accept its currency as payment for all private debts as well. The penalty for not paying taxes or for not accepting government currency as payment is jail.

In this way the government/central bank alliance has effectively created a situation where everyone under the government’s claimed jurisdiction is forced to use its fiat money. There is no way to completely opt out; at minimum everyone has to acquire enough fiat money to pay taxes or else they will be thrown in jail. And we’re not talking about one or two little taxes; we are talking about taxes on all income earned, taxes on all investment gains earned, taxes on all real estate owned, taxes on all vehicles owned, taxes on all gas purchased for those vehicles, taxes on all food and goods purchased, and taxes on any inheritance received. Virtually everything you do is taxed!

Add up all of the taxes across all levels of government and it is very likely you are paying out 50% of what you earn in taxes, especially if you live in a major metropolitan city. That means you are working six months of the year just to pay the government.

But wait, it gets even better!

The central bank is free to issue as much new fiat money as it pleases and the record clearly shows that all central banks very much enjoy creating lots of new currency. The law of supply and demand tells us that each unit of currency will be worth less as new currency enters the economy – this is intuitive. What’s less intuitive is something called the Cantillon Effect.

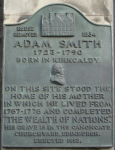

Classical economist Richard Cantillon noticed something very important about inflation back around 1730 in France. Cantillon observed that the original recipients of newly created money enjoyed much higher standards of living at the expense of later recipients. The reason for this, Cantillon noted in his economic treatise Essai, is because of the disproportionate rise in prices as a result of inflation; prices do not rise until after the first recipients of the new money spend it into the general economy.

What this means is the very act of creating new money from nothing effectively steals purchasing power from everyone except those who first receive the new money!

So who first receives the new money? Why, governments and their favored institutions of course! This is how governments and their favored institutions grew to be so fantastically large in the 1900’s – they steadily picked the public’s pocket for an entire century!

To tie it all together: Government creates currency from nothing and forces you to use it by levying all manner of taxes on you that can only be paid with the government’s fiat money. Then Government’s buddy, the central bank, inflates the money supply which depreciates the value of the currency you are forced to use and transfers that lost purchasing power from you to Government. This makes it very difficult for you to save money because the money constantly loses value over time. The result is you have to work harder and harder just to pay off Government lest it throw you in jail. And that is how fiat money enslaves society.

This process is why you could drive down Main Street in Small Town USA back in 1950 and see bustling storefronts and a vibrant economy. Drive down that same Main Street today and you will probably see empty buildings and boarded up windows. You just can’t earn an honest living as a small proprietor or shopkeep anymore because you are Cantillon’s last recipient of new money in those businesses. Decades of unrestricted inflation has destroyed the value of the money to the point where small proprietors cannot earn enough of it to keep up with rising prices. Fiat money has hollowed out Middle America to the point where there’s not much of it left. This is exactly what has happened throughout history where fiat money has been implemented – the middle class is destroyed.

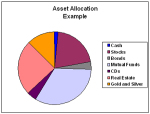

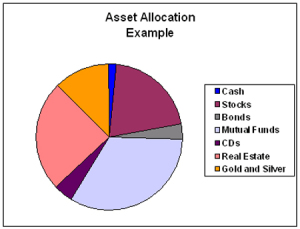

Governments have experimented with fiat money all through history and the most recent monetary model is the most deceptive to date. Fortunately, a fiat monetary system always sows the seeds of its own destruction and cannot last forever. In the meantime you can employ some basic financial strategies to protect yourself once you understand how the fiat money system works. We’ll look at some of those strategies in a later entry.

Until the morrow,

Joe Withrow

Wayward Philosopher

For more of Joe’s thoughts on the “Great Reset” and the fiat monetary system please read “The Individual is Rising” which is available at http://www.theindividualisrising.com/. The book is also available on Amazon in both paperback and Kindle editions.