submitted by jwithrow.

Financial success is all about understanding and mastering interest. You see, there are only three choices when it comes to financial matters:

- Pay interest

- Receive interest

- Forego interest

That’s it.

All you must do to get ahead financially is to arrange your financial affairs such that more interest is coming in than going out.

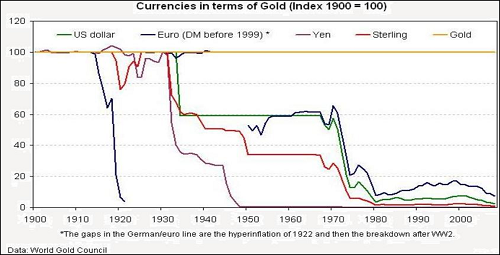

It is the quantity of interest that’s important. This concept is not often discussed so most folks focus exclusively on the rate of interest instead.

3.5% for a mortgage? This is a great rate!

2.87% for a vehicle loan? We’ll take two!

.05% on a savings account? Well, we suppose something is better than nothing.

So the average person pays interest for their house and their cars and they forego interest when they buy their groceries and pursue entertainment. The interest that they do receive is negligible in comparison because they offer whatever capital they have leftover after expenses for a pittance.

So what’s the common man to do?

CNBC will say that the stock market is the only way to go.

What they will not tell you is that the stock market is ripe with risk. Getting into the stock market requires you to give up control of your capital and place it 100% at risk. All the while you have the hedge fund high frequency trading machines and the Wall Street insiders chomping at the bit to take your capital from you.

These forces are focused on the stock market every minute of every day, not just during business hours.

If you have the same amount of time and energy as well as access to the same amount of information as the insiders then you may be able to play the stock market and come out ahead in real terms.

We think that it is much more likely that you will only come out ahead in nominal terms at best if you come out ahead at all.

We think it a far better strategy to capitalize an IBC policy and then focus on employing that capital to develop sustainable sources of income.

The IBC policy ensures that your capital is generating a little bit of interest no matter what happens and your employment of that capital can be used to significantly increase the amount of interest coming in.

After all, what good is a 3.5% mortgage if you are not generating at least 3.6% in interest income consistently?

You see, interest rates are not terribly important – it is mastering the control of interest in vs. interest out that is truly the name of the game.