by Jeff Clark – Hard Assets Alliance :

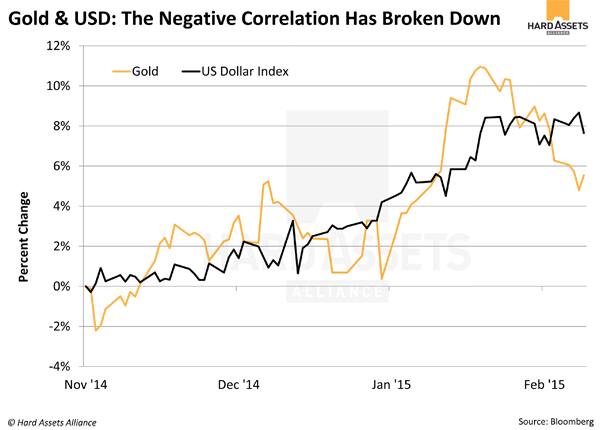

Gold and the US dollar typically exhibit an inverse relationship—when one climbs, the other tends to fall. But that relationship disappeared over three months ago.

Why the new romance between gold and the dollar? Primarily because what has been supportive for the dollar has also been good for gold.

This trend should continue. I’m not the only one to think so:

• “The resilience of gold in the face of a surging dollar and collapsing oil price supports our view that the precious metal will recover further this year and next.” (Capital Economics head of research Julian Jessop)

Do you believe there is greater or lesser risk in the financial markets? Will there be more or less fear in the world in 2015?

If you suspect that ever-optimistic government figures are masking far uglier truths… if you understand that the US economy depends on the global economy for far more than exports… if you believe the truly historic amount of money printing in the US and around the world must eventually result in inflation… or if for any reason you doubt that 2015 will be rosy, then the best investment strategy is one that includes a meaningful amount of gold bullion.

Remember: The issue is not inflation vs. deflation, the USD vs. euro, or even supply vs. demand. It’s fear and chaos vs. confidence and stability. Whichever of these you see as the stronger trend in the years ahead should drive your action plan.

In our view, the response we’ve seen thus far in gold has been a small foretaste of the major move we can expect when the wheels come off the global financial system, whatever form that may take.

My friends, buffer your investments and way of life against a growing level of financial risk. I urge you to continue adding low-cost bullion to your Hard Assets Alliance account.

Article originally posted in the February issue of Smart Metals Investor at HardAssetsAlliance.com.