submitted by jwithrow.

Journal of a Wayward Philosopher

Preventative Care

November 12, 2014

Hot Springs, VA

The S&P opened at $2,028. Gold, starting to recover from its recent mugging, is up to $1,165. Oil is down to $77.25 and contemplating testing its support level. Bitcoin is up to $396 per BTC, and the 10-year Treasury rate opened at 2.34%.

Precious metals are still the asset class that most warrants your attention in the financial markets today. The U.S. mint sold 5.8 million ounces of silver in October which was a 40% increase from September sales. The Mint then started the month of November off by selling another 1.3 million ounces.

Then it ran out of silver to sell.

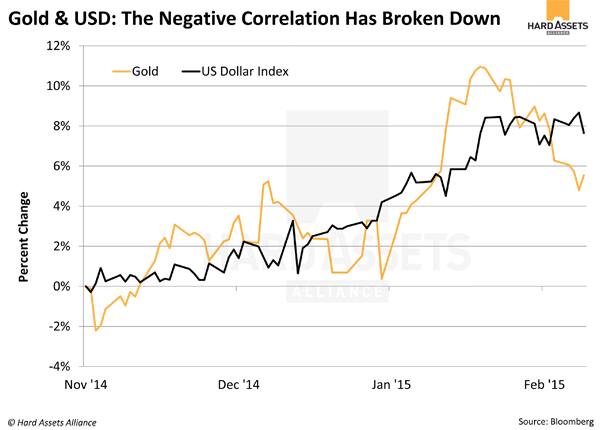

But guess what happened to the price of silver? It dropped from $19.50 per ounce on September 1 to $15.72 per ounce as the closing bell rang yesterday. Concurrently, the gold forward rate has just gone negative for the sixth time in fourteen years which suggests the market is pricing for a physical gold shortage. Despite this, the price of gold has been systematically beaten down in 2014 as well. What was that old saying about supply and demand?

Both gold and silver will probably flop around a bit for a while longer but ten years from now you will look quite wise if you allocate some of your capital to precious metals at the current prices.

Shifting gears to continue with our recent health care theme…

Last week we pondered a new model for health care based on cash payments for personalized service in order to opt out of the big-government/big-insurance/big-pharma cartel. We reckoned such a model would be similar to the free market model of a bygone era where family doctors had the freedom to offer personalized service to patients without having to worry about an avalanche of insurance paperwork needing to be complied with or a legion of attorneys hiding in the bushes outside looking for a malpractice lawsuit. We also reckoned there will be a small but growing number of health care professionals willing to offer personalized service for cash as the health insurance industry in the U.S. continues to spiral down into a sinkhole of bureaucracy.

What we didn’t ponder last week was how to afford a cash-based model and keep the insurance company in the waiting room unless an emergency occurs. The answer is simple: preventative care.

No, not the preventative care where you run to the specialist and sign up for the latest and greatest test or screening every time you think you might have sniffled in your sleep the night before. We mean the preventative care where you actually take responsibility for your own health and wellness.

The general guidelines are really pretty intuitive: get a good night’s sleep, stay active during the day even if you work behind a desk, walk as much as possible, eat real food and avoid the fake food that comes packaged in boxes and bags, drink plenty of water and not much soda, consider natural supplements and stay away from pharmaceutical drugs, reject stress and negativity, and maintain a positive state of mind.

Do these things consistently and you probably won’t ever get sick. And if you don’t get sick you won’t feel the need to go to the doctor – not even for checkups if you trust yourself implicitly. Then you could take the money you would have spent on doctor visits and prescription drugs and work on your asset allocation model.

Of course it is still advisable to maintain a wellness network. There are plenty of people and groups out there in cyberspace discussing natural health topics and answering each other’s questions at any given time of day. Though I gave it up years ago, I understand there are plenty of active Facebook groups in this space also.

Wife Rachel and I are big fans of routine chiropractic care as well. Instead of pushing a pill for every ill, chiropractors embrace a more holistic approach to wellness by focusing on musculoskeltal health to ensure optimal functionality of the nervous system. We found chiropractic care to be an especially important part of Rachel’s prenatal and postpartum wellness and it is an excellent tool to monitor the development of little Madison’s nervous system. You know how the pediatrician taps infants on the knee with the little hammer tool? Chiropractors do that too along with numerous other more advanced bio-mechanical and reactionary measurements.

Fortunately for the sake of this journal entry, many chiropractors operate on a cash-only basis. That is, they do not deal with insurance companies (they will accept credit cards). This eliminates the extra costs associated with insurance paperwork and compliance which means lower prices for clients. Some insurance policies may cover chiropractic care but it would be up to the client to file for reimbursement in that case. Ask the chiropractor whether or not his services are covered by insurance and he will probably say “I don’t know” and explain that your insurance policy is a private contract between you and the insurance company and has nothing to do with him (or her). How refreshing to know there is still a sliver of honesty and respectability left in the health care field!

With the proper mindset, preventative care is really quite easy so why do most people ignore it? One cannot know for certain but I suspect propagated fear has a lot to do with it. We’ll save that for a later entry…

More to come,

Joe Withrow

Wayward Philosopher

For more of Joe’s thoughts on the “Great Reset” and regaining individual sovereignty please read “The Individual is Rising” which is available at http://www.theindividualisrising.com/. The book is also available on Amazon in both paperback and Kindle editions.