submitted by jwithrow.

Journal of a Wayward Philosopher

Capitalism and Creditism and Corporatism, Oh My!

December 26, 2014

Hot Springs, VA

The S&P opened at $2,084 today. Gold is flat around $1,198 per ounce. Oil is still checking in at $56 per barrel. Bitcoin is at $326 per BTC, and the 10-year Treasury rate opened at 2.24% today.

All is quiet in the markets this holiday season. We may look back on this time period in a few years and say that we were presented with a tremendous opportunity to buy beaten down energy and commodity stocks during the tax-loss selling season of 2014. We probably will say that we had a great opportunity to accumulate some gold throughout 2014 as well. Just be sure to follow your asset allocation model if you decide to capitalize on these opportunities.

Yesterday we examined our current economic circumstances and realized that we were employing capitalism but we had no capital! Today we must ask the question: How can you have capitalism without any capital?

The obvious answer is you can’t. It’s like making potato soup without potatoes – try as you might it just won’t work.

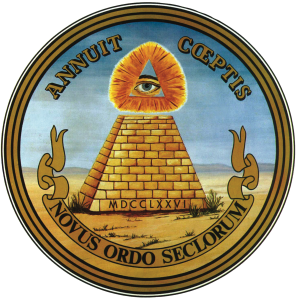

So if we don’t have capitalism then what do we have? My answer is that we have some weird blend of creditism and corporatism. Governments have colluded with large corporate interests, especially in the commercial banking sector, to rig the economy in their favor.

Though we could go back further, let’s start our story (from the American perspective) at the end of World War II. Prior to the war governments didn’t think they could do everything they wanted due to financial constraints. That didn’t stop them from doing half of what they wanted to do but it forced them to make a choice. Did they want guns (warfare) or butter (welfare)?

The U.S. came out of WWII looking like gold… literally. The U.S. economy was the least damaged by the war which ravaged Europe and it came out holding the world’s largest stash of gold reserves. This relative economic strength gave U.S. politicians the wrong idea: they started to think they might not need to make any choices. Then President Lyndon Johnson came along and he wasn’t shy about it – guns

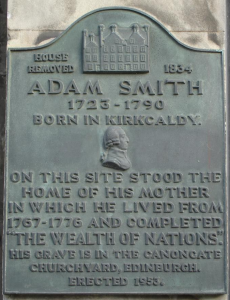

So we got the Vietnam War and the Great Society together! And gold steadily flowed out of the U.S. Treasury until President Nixon pulled the switch-a-roo in 1971 and closed the gold window. All of a sudden the international monetary system became elastic. With no more gold restraint, dollars and yen and pounds started to pile up as central banks and commercial banks discovered they could conjure money into existence largely at will. But this was a different kind of money than the gold-backed variety – it was credit-based.

This credit-based money was extremely popular and the money supply grew 50-fold between World War II and 2008. Everyone got used to a constantly expanding money supply and now both the economy and asset prices are dependent upon it. It is the expansion of credit, not real capital, that supports all of the federal spending programs, all of the wars in the Middle East, the mass imports from China and Vietnam, the new housing developments and shopping malls in Middle America, the massive car lots across the country, most of the skyscrapers dotting the city skies, and current real estate and stock market valuations.

Here’s a fun example: do you know how much debt is still owed on the tax-funded Meadowlands Sports Complex in New Jersey? I’ll tell you: more than $100 million is still owed on the facility. Oh, and I am talking about the old Meadowlands Stadium that was closed and demolished in 2009 to make way for a new $1.6 billion facility now known as MetLife Stadium. New Jersey taxpayers are still on the hook for $100 million on a sports complex that no longer exists! New Jersey built the stadium, used the stadium, and demolished the stadium but never bothered to pay for it.

Such nonsense can only occur in a world of ever-expanding credit-based funny money.

This applies to the massive bank bailouts and banker bonuses that one side of the fictitious aisle rails against just as it applies to the massive welfare programs that the other side of the false political-divide takes issue with. None of it exists without perpetual credit expansion; none of it exists without creditism and corporatism.

Capitalism would have nothing to do with any of it.

It is important to understand that we have only seen one side of the credit cycle within the current monetary system. Credit has been expanding constantly for more than forty years now. But if we look around our world we can clearly see that nothing expands forever. Waves rise then fall. Trees grow then mature. Balloons inflate then pop.

One day credit will have to contract; it is inevitable. What happens when that day comes? Ludwig von Mises, the late Austrian School economist, offered some insight:

“There is no means of avoiding a final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as a result of a voluntary abandonment of further credit expansion or later as a final and total catastrophe of the currency system involved.”

Was he right? Time will tell.

Joe Withrow

Wayward Philosopher

For more of Joe’s thoughts on the “Great Reset” and the fiat monetary system please read “The Individual is Rising” which is available at http://www.theindividualisrising.com/. The book is also available on Amazon in both paperback and Kindle editions.