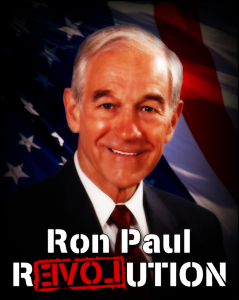

by Ron Paul – Ron Paul Institute for Peace and Prosperity:

Over the last 100 years the Fed has had many mandates and policy changes in its pursuit of becoming the chief central economic planner for the United States. Not only has it pursued this utopian dream of planning the US economy and financing every boondoggle conceivable in the welfare/warfare state, it has become the manipulator of the premier world reserve currency.

As Fed Chairman Ben Bernanke explained to me, the once profoundly successful world currency – gold – was no longer money. This meant that he believed, and the world has accepted, the fiat dollar as the most important currency of the world, and the US has the privilege and responsibility for managing it. He might even believe, along with his Fed colleagues, both past and present, that the fiat dollar will replace gold for millennia to come. I remain unconvinced.

At its inception the Fed got its marching orders: to become the ultimate lender of last resort to banks and business interests. And to do that it needed an “elastic” currency. The supporters of the new central bank in 1913 were well aware that commodity money did not “stretch” enough to satisfy the politician’s appetite for welfare and war spending. A printing press and computer, along with the removal of the gold standard, would eventually provide the tools for a worldwide fiat currency. We’ve been there since 1971 and the results are not good.

Many modifications of policy mandates occurred between 1913 and 1971, and the Fed continues today in a desperate effort to prevent the total unwinding and collapse of a monetary system built on sand. A storm is brewing and when it hits, it will reveal the fragility of the entire world financial system.

The Fed and its friends in the financial industry are frantically hoping their next mandate or strategy for managing the system will continue to bail them out of each new crisis.

The seeds were sown with the passage of the Federal Reserve Act in December 1913. The lender of last resort would target special beneficiaries with its ability to create unlimited credit. It was granted power to channel credit in a special way. Average citizens, struggling with a mortgage or a small business about to go under, were not the Fed’s concern. Commercial, agricultural, and industrial paper was to be bought when the Fed’s friends were in trouble and the economy needed to be propped up. At its inception the Fed was given no permission to buy speculative financial debt or U.S. Treasury debt.

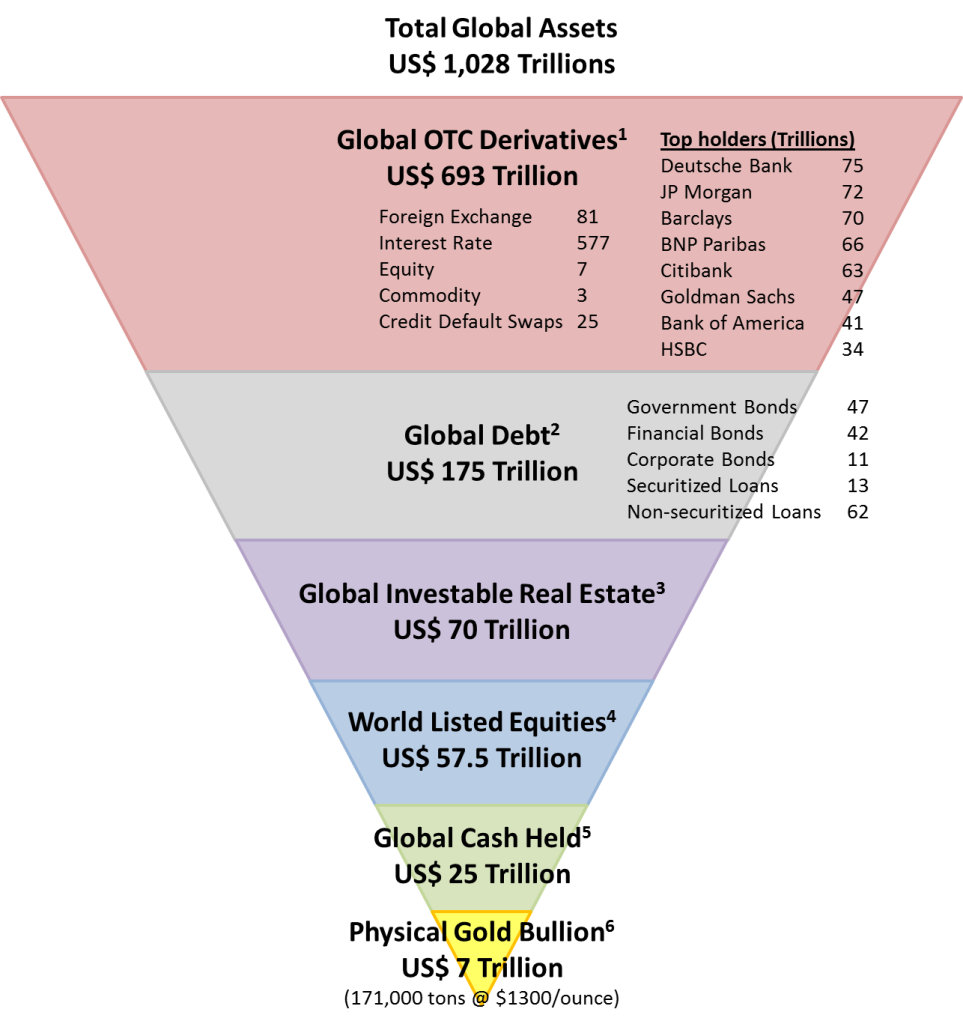

It didn’t take long for Congress to amend the Federal Reserve Act to allow the purchase of US debt to finance World War I and subsequently all the many wars to follow. These changes eventually led to trillions of dollars being used in the current crisis to bail out banks and mortgage companies in over their heads with derivative speculations and worthless mortgage-backed securities.

It took a while to go from a gold standard in 1913 to the unbelievable paper bailouts that occurred during the crash of 2008 and 2009.

In 1979 the dual mandate was proposed by Congress to solve the problem of high inflation and high unemployment, which defied the conventional wisdom of the Phillips curve that supported the idea that inflation could be a trade-off for decreasing unemployment. The stagflation of the 1970s was an eye-opener for all the establishment and government economists. None of them had anticipated the serious financial and banking problems in the 1970s that concluded with very high interest rates.

That’s when the Congress instructed the Fed to follow a “dual mandate” to achieve, through monetary manipulation, a policy of “stable prices” and “maximum employment.” The goal was to have Congress wave a wand and presto the problem would be solved, without the Fed giving up power to create money out of thin air that allows it to guarantee a bailout for its Wall Street friends and the financial markets when needed.

The dual mandate was really a triple mandate. The Fed was also instructed to maintain “moderate long-term interest rates.” “Moderate” was not defined. I now have personally witnessed nominal interest rates as high as 21% and rates below 1%. Real interest rates today are actually below zero.

The dual, or the triple mandate, has only compounded the problems we face today. Temporary relief was achieved in the 1980s and confidence in the dollar was restored after Volcker raised interest rates up to 21%, but structural problems remained.

Nevertheless, the stock market crashed in 1987 and the Fed needed more help. President Reagan’s Executive Order 12631 created the President’s Working Group on Financial Markets, also known as the Plunge Protection Team. This Executive Order gave more power to the Federal Reserve, Treasury, Commodity Futures Trading Commission, and the Securities and Exchange Commission to come to the rescue of Wall Street if market declines got out of hand. Though their friends on Wall Street were bailed out in the 2000 and 2008 panics, this new power obviously did not create a sound economy. Secrecy was of the utmost importance to prevent the public from seeing just how this “mandate” operated and exactly who was benefiting.

Since 2008 real economic growth has not returned. From the viewpoint of the central economic planners, wages aren’t going up fast enough, which is like saying the currency is not being debased rapidly enough. That’s the same explanation they give for prices not rising fast enough as measured by the government-rigged Consumer Price Index. In essence it seems like they believe that making the cost of living go up for average people is a solution to the economic crisis. Rather bizarre!

The obsession now is to get price inflation up to at least a 2% level per year. The assumption is that if the Fed can get prices to rise, the economy will rebound. This too is monetary policy nonsense.

If the result of a congressional mandate placed on the Fed for moderate and stable interest rates results in interest rates ranging from 0% to 21%, then believing the Fed can achieve a healthy economy by getting consumer prices to increase by 2% per year is a pie-in-the-sky dream. Money managers CAN’T do it and if they could it would achieve nothing except compounding the errors that have been driving monetary policy for a hundred years.

A mandate for 2% price inflation is not only a goal for the central planners in the United States but for most central bankers worldwide.

It’s interesting to note that the idea of a 2% inflation rate was conceived 25 years ago in New Zealand to curtail double-digit price inflation. The claim was made that since conditions improved in New Zealand after they lowered their inflation rate to 2% that there was something magical about it. And from this they assumed that anything lower than 2% must be a detriment and the inflation rate must be raised. Of course, the only tool central bankers have to achieve this rate is to print money and hope it flows in the direction of raising the particular prices that the Fed wants to raise.

One problem is that although newly created money by central banks does inflate prices, the central planners can’t control which prices will increase or when it will happen. Instead of consumer prices rising, the price inflation may go into other areas, as determined by millions of individuals making their own choices. Today we can find very high prices for stocks, bonds, educational costs, medical care and food, yet the CPI stays under 2%.

The CPI, though the Fed currently wants it to be even higher, is misreported on the low side. The Fed’s real goal is to make sure there is no opposition to the money printing press they need to run at full speed to keep the financial markets afloat. This is for the purpose of propping up in particular stock prices, debt derivatives, and bonds in order to take care of their friends on Wall Street.

This “mandate” that the Fed follows, unlike others, is of their own creation. No questions are asked by the legislators, who are always in need of monetary inflation to paper over the debt run up by welfare/warfare spending. There will be a day when the obsession with the goal of zero interest rates and 2% price inflation will be laughed at by future economic historians. It will be seen as just as silly as John Law’s inflationary scheme in the 18th century for perpetual wealth for France by creating the Mississippi bubble – which ended in disaster. After a mere two years, 1719 to 1720, of runaway inflation Law was forced to leave France in disgrace. The current scenario will not be precisely the same as with this giant bubble but the consequences will very likely be much greater than that which occurred with the bursting of the Mississippi bubble.

The fiat dollar standard is worldwide and nothing similar to this has ever existed before. The Fed and all the world central banks now endorse the monetary principles that motivated John Law in his goal of a new paradigm for French prosperity. His thesis was simple: first increase paper notes in order to increase the money supply in circulation. This he claimed would revitalize the finances of the French government and the French economy. His theory was no more complicated than that.

This is exactly what the Federal Reserve has been attempting to do for the past six years. It has created $4 trillion of new money, and used it to buy government Treasury bills and $1.7 trillion of worthless home mortgages. Real growth and a high standard of living for a large majority of Americans have not occurred, whereas the Wall Street elite have done quite well. This has resulted in aggravating the persistent class warfare that has been going on for quite some time.

The Fed has failed at following its many mandates, whether legislatively directed or spontaneously decided upon by the Fed itself – like the 2% price inflation rate. But in addition, to compound the mischief caused by distorting the much-needed market rate of interest, the Fed is much more involved than just running the printing presses. It regulates and manages the inflation tax. The Fed was the chief architect of the bailouts in 2008. It facilitates the accumulation of government debt, whether it’s to finance wars or the welfare transfer programs directed at both rich and poor. The Fed provides a backstop for the speculative derivatives dealings of the banks considered too big to fail. Together with the FDIC’s insurance for bank accounts, these programs generate a huge moral hazard while the Fed obfuscates monetary and economic reality.

The Federal Reserve reports that it has over 300 PhD’s on its payroll. There are hundreds more in the Federal Reserve’s District Banks and many more associated scholars under contract at many universities. The exact cost to get all this wonderful advice is unknown. The Federal Reserve on its website assures the American public that these economists “represent an exceptional diverse range of interest in specific area of expertise.” Of course this is with the exception that gold is of no interest to them in their hundreds and thousands of papers written for the Fed.

This academic effort by subsidized learned professors ensures that our college graduates are well-indoctrinated in the ways of inflation and economic planning. As a consequence too, essentially all members of Congress have learned these same lessons.

Fed policy is a hodgepodge of monetary mismanagement and economic interference in the marketplace. Sadly, little effort is being made to seriously consider real monetary reform, which is what we need. That will only come after a major currency crisis.

I have quite frequently made the point about the error of central banks assuming that they know exactly what interest rates best serve the economy and at what rate price inflation should be. Currently the obsession with a 2% increase in the CPI per year and a zero rate of interest is rather silly.

In spite of all the mandates, flip-flopping on policy, and irrational regulatory exuberance, there’s an overwhelming fear that is shared by all central bankers, on which they dwell day and night. That is the dreaded possibility of DEFLATION.

A major problem is that of defining the terms commonly used. It’s hard to explain a policy dealing with deflation when Keynesians claim a falling average price level – something hard to measure – is deflation, when the Austrian free-market school describes deflation as a decrease in the money supply.

The hysterical fear of deflation is because deflation is equated with the 1930s Great Depression and all central banks now are doing everything conceivable to prevent that from happening again through massive monetary inflation. Though the money supply is rapidly rising and some prices like oil are falling, we are NOT experiencing deflation.

Under today’s conditions, fighting the deflation phantom only prevents the needed correction and liquidation from decades of an inflationary/mal-investment bubble economy.

It is true that even though there is lots of monetary inflation being generated, much of it is not going where the planners would like it to go. Economic growth is stagnant and lots of bubbles are being formed, like in stocks, student debt, oil drilling, and others. Our economic planners don’t realize it but they are having trouble with centrally controlling individual “human action.”

Real economic growth is being hindered by a rational and justified loss of confidence in planning business expansions. This is a consequence of the chaos caused by the Fed’s encouragement of over-taxation, excessive regulations, and diverting wealth away from domestic investments and instead using it in wealth-consuming and dangerous unnecessary wars overseas. Without the Fed monetizing debt, these excesses would not occur.

Lessons yet to be learned:

1. Increasing money and credit by the Fed is not the same as increasing wealth. It in fact does the opposite.

2. More government spending is not equivalent to increasing wealth.

3. Liquidation of debt and correction in wages, salaries, and consumer prices is not the monster that many fear.

4. Corrections, allowed to run their course, are beneficial and should not be prolonged by bailouts with massive monetary inflation.

5. The people spending their own money is far superior to the government spending it for them.

6. Propping up stock and bond prices, the current Fed goal, is not a road to economic recovery.

7. Though bailouts help the insiders and the elite 1%, they hinder the economic recovery.

8. Production and savings should be the source of capital needed for economic growth.

9. Monetary expansion can never substitute for savings but guarantees mal–investment.

10. Market rates of interest are required to provide for the economic calculation necessary for growth and reversing an economic downturn.

11. Wars provide no solution to a recession/depression. Wars only make a country poorer while war profiteers benefit.

12. Bits of paper with ink on them or computer entries are not money – gold is.

13. Higher consumer prices per se have nothing to do with a healthy economy.

14. Lower consumer prices should be expected in a healthy economy as we experienced with computers, TVs, and cell phones.

All this effort by thousands of planners in the Federal Reserve, Congress, and the bureaucracy to achieve a stable financial system and healthy economic growth has failed.

It must be the case that it has all been misdirected. And just maybe a free market and a limited government philosophy are the answers for sorting it all out without the economic planners setting interest and CPI rate increases.

A simpler solution to achieving a healthy economy would be to concentrate on providing a “SOUND DOLLAR” as the Founders of the country suggested. A gold dollar will always outperform a paper dollar in duration and economic performance while holding government growth in check. This is the only monetary system that protects liberty while enhancing the opportunity for peace and prosperity.

Article originally posted at The Ron Paul Institute for Peace and Prosperity.