submitted by jwithrow.

Journal of a Wayward Philosopher

Capitalism Without the Capital

December 25, 2014

Hot Springs, VA

Merry Christmas!

The markets are closed today in honor of this wonderful holiday so we have no updates for you in this entry. Check back in with us tomorrow for market updates. We do have an important entry for you today, however. It’s not nearly as important as spending time with your family on Christmas Day but, since you are here nonetheless, we will carry on.

Earlier this month we watched as the U.S. national debt came up behind $18 trillion, whipped into the passing lane without signaling, and sped off into the distance. Where is the national debt going in such a rush? I’m not sure, but I’d wager it’s someplace not worth going to.

As the national debt raced past we noted that total credit market debt has ballooned up to 330% of GDP with considerable help from the Fed’s efforts to pump in $4.3 trillion worth of hot air.

The television analysts accept it all as normal but we must ask the question: How in the world did we get to this point?

Much of the apparent prosperity we have enjoyed over the last several years has been borrowed from the future. The world’s three major central banks – The Federal Reserve, the European Central Bank, and the Bank of Japan – have each been engaged in an outrageous financial experiment; they have been creating massive amounts of currency out of thin air to purchase government debt by the boat-load.

Remember, debt is nothing more than a promise to pay for present spending with future earnings. These central banks, in collusion with their respective government, are really engaged in a scheme to transfer massive amounts of wealth from the public in the future to themselves in the present. There will be serious consequences to this madness.

It is important to realize that none of this chicanery has anything to do with capitalism… there’s no capital even in sight! The money created by the central banks of the world may act much like real capital, but it is just a clever impersonator.

Capital, according to the Ludwig von Mises Institute, is defined as the goods that were produced by previous stages of production but do not directly satisfy consumer’s needs. In short, capital is real savings and real resources.

Capital formation is actually quite simple – just save more than you consume and you will have capital.

We are currently doing the opposite – we are consuming way more than we produce. That’s how you end up with debt piled to the ceiling. This is true on the macro level (governments, multi-national corporations, etc.) and it is true on the micro level (individuals, local communities). The credit-based money and the massive debt have driven capital into hiding… we suspect for fear of being called a greedy capitalist.

And that, in a nutshell, is the answer to our question: we got to this point by embracing central banking and fiat money thus abandoning capitalism and its sound monetary system.

Sound Money once kept debt and the central planners at bay.

What was the secret?

Sound Money was like your grumpy friend that just won’t ever agree to do anything. You ask him to go to the movies and he says nope. You ask him to go to the ball game and he says he’ll watch it on T.V. You ask him to go to the bar and he says he has beer in the fridge at home already. Eventually you learn there’s nothing you can talk him into doing so you stop trying. That’s why governments and central banks hated Sound Money; it would never agree to any of their best laid plans.

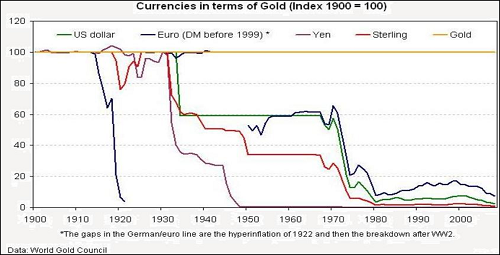

You see, Sound Money could not be infinitely printed by governments or central banks. Originally, before governments got into the money business, money could not be printed at all; it had to be dug out of the ground and then minted into a coin. Later, governments took it upon themselves to stockpile gold in a vault and create paper currencies 100% backed by the gold. Always one to offer something it doesn’t have at a price it cannot sustain, Government reduced the gold backing of its currency over time and then, in 1971, it cut ties to gold altogether. That was the requiem for Sound Money and ever since then there has been absolutely no limits on the amount of currency central banks can create. Which means there has also been absolutely no limit on how much debt governments can rack up.

So here we are.

But just because there have been no limits to all of this economic madness in the short run does not mean there will never again be any limits. History shows that market forces cannot be perpetually suppressed and distorted – eventually the market will win out. The Day of Reckoning will come.

Joe Withrow

Wayward Philosopher

For more of Joe’s thoughts on the “Great Reset” and the fiat monetary system please read “The Individual is Rising” which is available at http://www.theindividualisrising.com/. The book is also available on Amazon in both paperback and Kindle editions.