submitted by jwithrow.

Click here to get the Journal of a Wayward Philosopher by Email

Journal of a Wayward Philosopher

The Only Debate Topic That Matters

September 29, 2016

Hot Springs, VA

“Loading up the nation with debt and leaving it for the following generations to pay is morally irresponsible. Excessive debt is a means by which governments oppress the people and waste their substance. No nation has a right to contract debt for periods longer than the majority contracting it can expect to live. ” – Thomas Jefferson

The S&P closed out Wednesday at $2,171. Gold closed at $1,327 per ounce. Crude Oil closed at $47.12 per barrel, and the 10-year Treasury rate closed at 1.57%. Bitcoin is trading around $605 per BTC today.

Dear Journal,

Nearly one-third of all Americans – almost 100 million people – tuned in to watch the first presidential debate earlier this week. This represents an increase in viewership by nearly 40% from the 2012 presidential debates, and it almost rivaled television’s biggest draw – the Super Bowl – which received 112 million viewers last year. Apparently the debate was aired on television throughout Europe as well.

I see these numbers and the first thing that pops into my head is a question: how in the world do the ratings agencies know how many people are sitting on the couch in front of a given television?

I didn’t spend too much time with this, but all of the numbers I have seen reference “viewers” and “people”, not “households”. They are very specific about this.

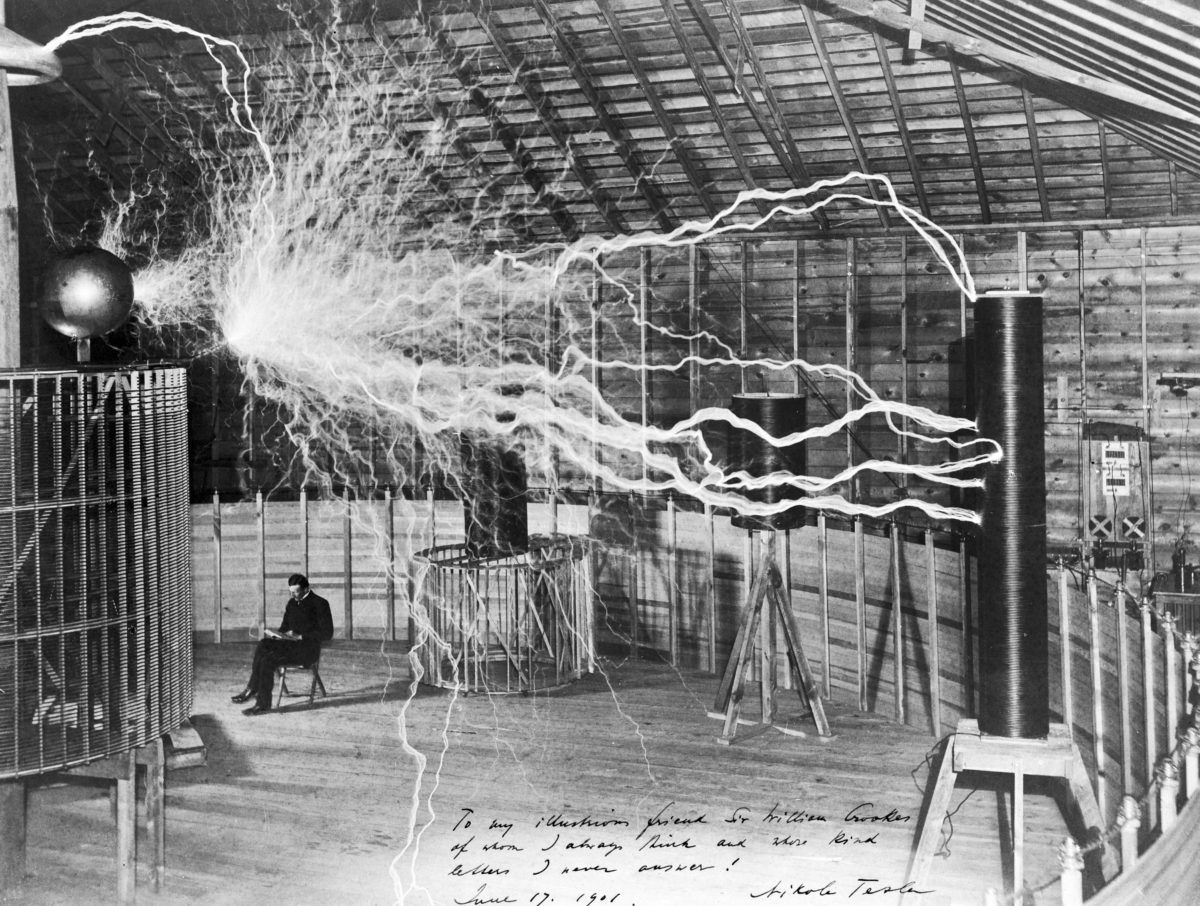

I can’t help but think about poor Winston in George Orwell’s 1984 – he sits down in front of his telescreen and while he is watching it, it is also watching him… Continue reading “The Only Debate Topic That Matters”