submitted by jwithrow.

Click

here to get the Journal of a Wayward Philosopher by Email

Journal of a Wayward Philosopher

Ban Bitcoin?

May 23, 2019

Hot Springs, VA

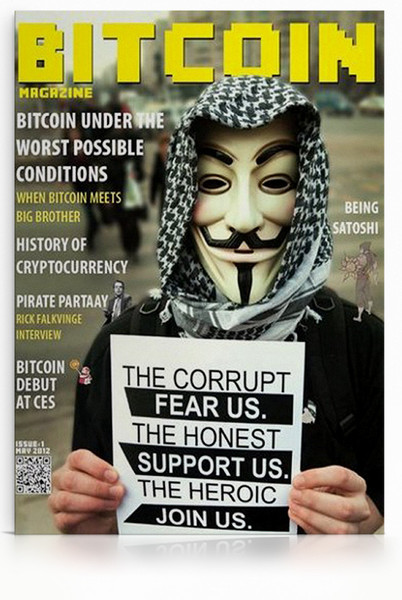

“Bitcoin is the most subversive technology on the planet. This is a system that is growing around the entire world. But Bitcoin is just math. The government, no matter how many guns they draw, cannot change a mathematical problem. They can point their guns at 2+2 but it’s always going to equal 4.” – Erik Vorhees

The S&P closed today’s trading session at $2,822. Gold closed at $1,283 per ounce. Crude Oil closed at $58.12 per barrel. The 10-year Treasury rate closed at 2.29%. Bitcoin is trading around $7,819 per BTC today.

Dear Journal,

Spring gradually gives way to summer up here in the mountains of Virginia.

And while the outside world frets over geopolitics… trade wars… wealth gaps… elections… and whatever else the news puts in front of them, I quietly admire the brilliance of nature.

You see, the seasons represent change. Unstoppable change. They turn with nature’s cycles whether we want them to or not.

Each season comes with its own beauty. And its own drawbacks.

The choice we have to make is whether to focus on the good… or the bad. That’s it.

And I believe that choice is what determines the course of our life.

Contentment or anger… love or hate… success or failure… it’s all in how we view the world.

Einstein said that there are only two ways to live. One is as though nothing is a miracle. The other is as though everything is.

Was he right? I don’t know. But I bet there’s some wisdom in there somewhere.

Continue reading “Ban Bitcoin?”