People who are in or approaching retirement today face immense challenges that those who retired in the years before them did not.

Simply put, we’ve been living in a bubble world since the 1980s, but the bubble popped in 2022.

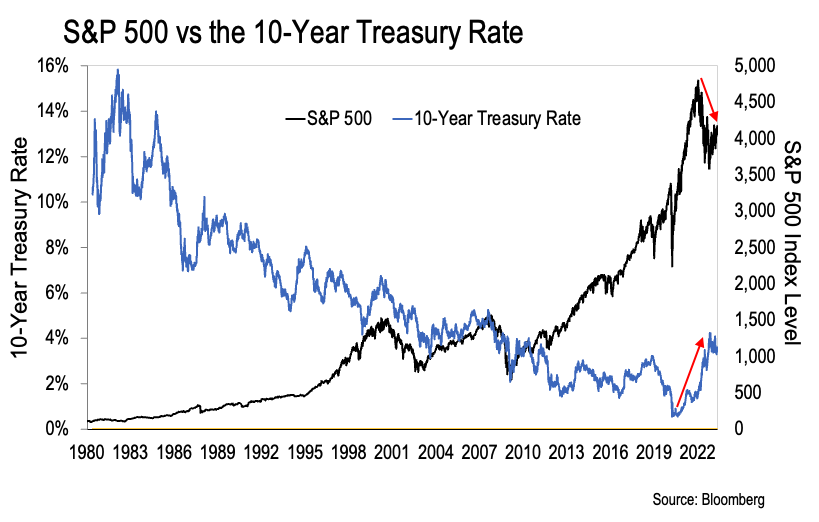

I think most of us know this to be true. We can feel it. But this next chart tells the story quite well:

Here we can see the S&P 500 and the 10-year Treasury rate going back to 1980. The S&P 500 is the black line. And the 10-year Treasury rate is the blue line.

We’re using the S&P 500 as a proxy for US stock prices. And we’re using the 10-year Treasury as a proxy for interest rates. This chart makes it perfectly clear that the two are inversely correlated.

Interest rates started falling in 1982, and they fell consistently for the next 40 years. Meanwhile, US stocks consistently went up in value over that same time period.

But everything reversed in 2022. Rates started going up, and stock prices started to fall. We can see those moves clearly marked by the red arrows on the chart above.

I keep coming back to this image because I want to hammer the message home. The Age of Paper Wealth is over.

The question is – what comes next?

We’ve talked all week about the secret war between the globalist power structure and the New York Banking Cartel. It’s all about answering this question. They know the game is up… and each faction wants to control what comes next.

Of course, this raises an important question for us. What do we do about it?

We’ve worked so hard to build up some wealth and plan for what we hope to be an enjoyable, meaningful retirement. But how do we plan strategically amidst all the uncertainties we see out there today?

To me, it comes down to four pillars. They are:

- Asset Allocation

- Portfolio Construction

- Cash Flow

- Alternative Investments

Let’s hit each of these briefly today.

Asset Allocation

Asset allocation is about spreading our money—our capital—across several different asset classes. I find it’s best to do this according to a personalized model. The purpose here is true diversification.

I suspect many of us hear the word diversification and CNBC’s definition comes to mind. You know, buy stocks in all kinds of different industries so that we have a diversified portfolio.

I don’t believe that.

Whenever we see market crashes or bear markets, they typically take all stocks down. Maybe utility stocks go down less than early-stage biotech stocks… but they go down all the same.

Asset allocation is about true diversification. Stocks are just one piece of the model.

So here’s what this looks like. An antifragile asset allocation model will consist of:

- 10–20% Cash

- 5–10% Gold

- 10–50% Real Estate

- 10–30% Stocks

- 0–10% Bonds

- 5–20% Bitcoin

- 0–5% Early-Stage Investments

Keep in mind this model is just a suggestion.

We should each tailor our allocation percentages according to our own circumstances. And we should adjust it over time as the macroeconomic conditions change.

Personally, I have a running spreadsheet I use to keep track of my own asset allocation model. It’s similar to a personal financial statement, but it compares my actual allocation in each asset class to my target allocation at all times.

Portfolio Construction

Portfolio construction refers to how we build our stock portfolio.

This is something we didn’t have to worry much about during The Age of Paper Wealth. We could just buy some growth stocks and let the market take them higher for years.

Today it’s a whole different game.

We need a bulletproof portfolio – one that can weather “higher for longer” interest rates and the coming recession. To get that, we need to focus on four specific buckets. They are:

- World-Class Insurance

- Energy Stocks

- Gold Equities

- Top-Tier Consumer Goods

We dedicated an entire email series to each of these, so I’ll just hit the highlights here.

World-Class Insurance refers to the world’s best property and casualty insurers. These companies sell policies that enterprises and consumers need to have—it’s not a choice.

Then the insurance companies invest the premiums they receive before they have to pay any claims. That’s where the magic happens.

This creates another revenue stream. And because these companies invest primarily in bonds and mortgages, their investment returns will grow significantly now that interest rates have risen.

For energy stocks – we should focus on both the oil & gas sector as well as uranium for nuclear power.

As we’ve discussed, solar and wind simply aren’t going to power our grid… because the power they produce isn’t constant – it’s intermittent. Yet we’ve poured trillions of dollars into companies working on solar and wind power.

That’s created a dynamic where we will see energy shortages… which will drive the price of oil, natural gas, and uranium higher. Let’s get ahead of it.

I also expect we’ll see the price of gold rise in the years to come.

We’re in a world where national governments are drenched in debt, alliances are shifting, trust is fading, and wars have broken out in eastern Europe and the Levant.

That’s a world in which gold should trade at a premium. The right gold stocks will add some pop to an otherwise conservative portfolio.

That leaves us with top-tier consumer goods companies.

These are well-managed companies who sell products that the American consumer will buy regardless of what happens with the economy.

Dollar General, Domino’s, Hershey, and Home Depot come to mind. They can serve as inflation hedges for us if we buy these stocks when they’re trading at attractive valuations.

That said, I don’t mean to suggest that we should only own stocks in these four buckets. But these four areas are likely to outperform the market over the next few years.

Cash Flow

Having multiple income streams will be even more important in the new climate we find ourselves in. As they say in real estate – cash flow is king.

And it just so happens that investment real estate is a great way to build cash flow.

Of course, real estate represented an amazing opportunity when we could lock in 30-year mortgages at 3.5%. But there are still markets today where investment properties will throw off 10-16% a year cash-on-cash returns – even with mortgage rates in the 7% range. Those opportunities are mostly in boring markets where home prices tend to be stable over time.

What I love about real estate is that there’s no guessing what our return on investment (ROI) will be.

That’s because the ROI for any property depends upon its monthly rent, purchase price, insurance costs, property taxes, management fees, and HOA dues (if any). We know each of these numbers up front.

So when we run the numbers and find that a property wouldn’t produce adequate cash flow for us, we don’t buy it. Simple.

And if we focus exclusively on cash flow like this, it doesn’t matter much whether real estate goes up or down in value. That’s key.

We’ll get our capital appreciation with stocks, Bitcoin, and our early stage investments. Let real estate be our tool to generate extra monthly income.

With that approach, investing in real estate becomes straightforward.

And just to quantify this, if we focus on rental properties that produce $500 a month in cash flow, we only need ten properties to create $5,000 a month in extra income.

That’s within the realm of possibility for anyone who has built a little retirement nest egg over their working years.

Alternative Investments

Alternative investments exist outside of our asset allocation model, but may prove immensely valuable in the years to come.

Of course, any kind of collection could fall into this category. Numismatic coins… classic cars… baseball cards… stamps – I know people who are fanatics about these things.

But I’m not. So to me, alternative investments are largely about home resiliency.

Home resiliency refers to the ability to be self-sufficient for at least six months within our home. That means we have all the food, water, and provisions we need to get by and maybe even live comfortably—even if we can’t leave our house or receive any deliveries.

It used to be that you were looked at as a crazy doomsday prepper if you talked about this concept. But then COVID-19 happened and we got lockdowns, travel restrictions, and all kinds of supply chain disruptions. Suddenly home resiliency seemed like a wise strategy.

When you’re just getting started, building six months of resiliency seems like a daunting task. But it’s not hard to achieve. And it doesn’t cost that much.

Home resiliency consists of four parts—food, water, energy, and provisions.

Let’s start with food…

The easiest way to build a food reserve is to buy pre-packaged food with a long shelf life. There are numerous companies out there that offer suitable products.

Mountain House, Wise Company, Augason Farms, Legacy Food Storage, My Patriot Supply, Thrive Life, and ReadWise each offer various food storage packages.

Keep in mind this is food specifically designed to have a long shelf life. It may not taste the best, and it may not be the most nutritious, but it’ll get us by in a pinch.

In addition, I like to keep some extra canned goods, rice, and peanut butter in the pantry as well. Just in case. We also keep our meat freezer stocked at all times.

Next up is water.

Water’s a bit more difficult to store because you don’t want it sitting in direct light for too long. Plus it takes up a fair amount of space. But I’ve got a pretty good solution here.

Water.com offers monthly and bi-weekly water delivery services. We can set up a subscription to receive five-gallon jugs of water from that site. Then a service representative will come out to our house every two weeks to bring us new jugs.

I started by buying 15 five-gallon jugs of water. Typically we go through three jugs every two weeks. Then when the service rep comes out, he simply replaces our empty jugs. Or he leaves us extra jugs if we ask him to.

As such, we have anywhere from 55 to 75 gallons of water on hand at all times. We just drink it as we go and replenish our stash every two weeks. Then we supplement that with bottled water.

The key here is to store the water out of direct sunlight and to be diligent with a rotation system, to ensure that your water never stagnates.

The next thing we need to think about is energy. We need something that provides heat and enables us to cook in case the power’s out during an emergency.

The easiest thing here is to buy a propane grill or two. I have a large one and one of the small portable grills. And I keep a few extra propane tanks on hand at all times. Easy and simple.

The other thing I highly recommend are solar-compatible batteries. We keep a few of these around the house, fully charged at all times.

These are batteries that can be charged by plugging them into the wall or hooking them into the solar panel they come with. The Jackery brand is probably the most popular of these products. The batteries are equipped with power outlets that work the same as our wall outlets. Thus, we can plug anything into them to get power.

They would be good for powering any electronic device for a limited period of time in a power outage. And if we drain the battery, we can always recharge it with the solar panel. See – solar’s good for something.

The larger expense to consider is a whole-home generator. I consider this a must if you want to keep a meat freezer stocked up. Just call Home Depot or Lowe’s and they’ll give you a quote.

And that brings us to provisions.

The big thing here is just to keep an extra supply of all of the items we use regularly: contacts, saline, paper towels, toilet paper, soap, toothpaste, flashlights, batteries, first-aid kits… whatever else.

We can buy these things in bulk and replace them as we go. That way we always have plenty of everything on hand.

So those are the four pillars: asset allocation, portfolio construction, cash flow, and alternative investments.

Put it all together and suddenly your money is bulletproof and your home is your castle. That’s a comforting feeling during uncertain times – come what may.

-Joe Withrow

P.S. For a deeper dive on each of these issues, please see my book Beyond the Nest Egg. You can find it on Amazon right here:Beyond the Nest Egg – How to Be Financially Independent Outside of a Broken System