The world as we know it changed last year.

From 1982 to 2022, the Federal Reserve (the Fed) created over $8 trillion from nothing to flood the financial system with liquidity. This drove interest rates consistently lower while pushing stock prices higher for forty years.

Nobody under the age of 60 has known anything else in their adult life.

In that era, stock prices tended to move in tandem. When an index like the S&P 500 or the Nasdaq was going up, most stocks in that index would go up also.

So being in the best stocks wasn’t as important as just being in the market. Nearly 1,000 “passive investing” exchange traded funds (ETFs) formed since 2008 to capitalize on this dynamic.

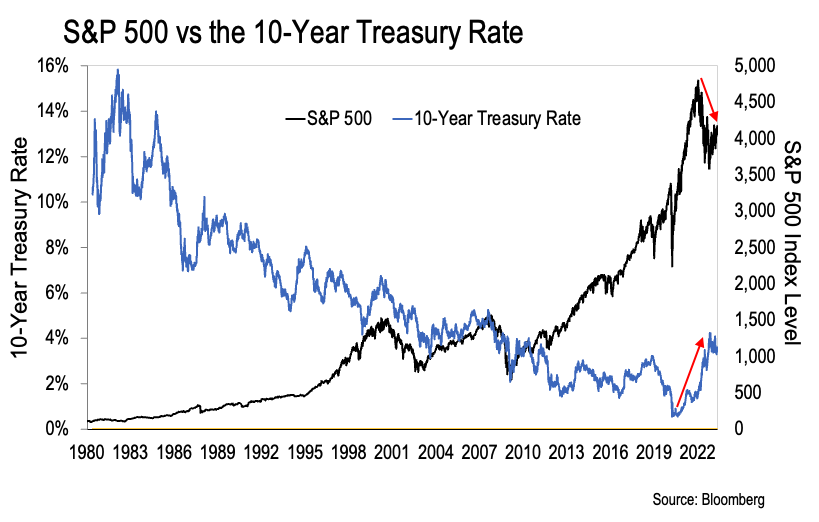

But the game’s over. This chart paints the picture:

In March of last year the Fed embarked on the most aggressive rate-hiking campaign in its 110 year history. That reversed the two primary trends.

Interest rates screamed higher—that’s the blue line in the chart above. And stocks began to march lower, as illustrated by the black line.

The red arrows make it clear… The Age of Paper Wealth is over.

But wait—Fed Chair Jerome Powell just declined to hike rates again for the second meeting in a row. Some analysts are now saying that the Fed is done raising rates.

And the S&P 500 is up over 6% in just the last week and a half in response. The same analysts say that’s evidence that stocks are about to go on a tear and the game is back on.

Here’s what they are missing…

The Story is Far More Complex

The “normie” understanding is that the Fed is raising interest rates to fight consumer price inflation. Then, when inflation comes back down, the Fed will cut rates again to juice the markets – just like it has for the last forty years.

This view sees inflation as a mysterious boogieman that rears its head every now and then. And it sees the Fed as a reactionary institution stepping up to fight it.

I submit to you that this is an overly simplistic view. And it ignores our current economic situation completely.

The fact is, we’ve lived in a “number go up” world for the last forty years. That is to say, we’ve been conditioned to think growth is perpetual and stock prices should always go up over time.

But none of it was natural.

To keep the numbers going up, the people pulling the strings of monetary and fiscal policy had to push interest rates ever-lower and constantly pump more and more printed money into the system. They called it stimulus.

The problem is, rates can only go so low. And the lower they go, the more malinvestment forms within the economy.

Malinvestment refers to projects and companies that just aren’t economical. They don’t produce enough value to pay for themselves.

And that makes them a mistake. They misallocate scarce resources that could have gone to something that would provide greater value to the market and to society.

This is nothing more than Adam Smith’s Invisible Hand principle at work. It comes from his masterpiece The Wealth of Nations.

Smith’s principle points out that the free market has incentives built-in to ensure that resources are allocated in an optimal way. At least most of the time. And when resources are misallocated, the market quickly purges the malinvestment to correct those mistakes.

We’ve known this for 247 years now. Smith’s book published in 1776. But we’ve ignored it… and we’ve made a lot of mistakes recently. Then we didn’t allow the market to correct those mistakes.

The Fed and the world’s central banks collaborated to drop interest rates to zero in 2008. They said it was necessary to save the financial system.

Whether that’s true or not doesn’t matter at this point. What matters is that their actions allowed an enormous amount of malinvestment to form.

Goldman Sachs estimates that 13% of all publicly traded companies in the US are zombie companies. The Fed puts its estimate at 10%.

Zombie companies are companies that can’t generate enough revenues to cover their debt-service costs. So they must consistently borrow more and more money to stay alive.

In a free market, these companies would be forced into bankruptcy very quickly. Nobody would lend them the money they needed to survive.

But in our “number go up” world of zero interest rates, these companies have been able to borrow money cheaply for over a decade now.

And that’s because the central banks fought tooth-and-nail to keep rates near zero. They haven’t allowed a correction to occur.

Until now.

What the Fed is Really Up To

The Fed is acting to save the financial system and the American economy. That’s what this is all about. Consumer price inflation is just a small part of the picture.

It’s almost like Mr. Powell has been studying up on his Austrian free market economics recently.

Those of us well-versed in Austrian economics know very well that zero-bound interest rates and fiscal “stimulus” are not sustainable.

Ludwig Von Mises spelled out the dilemma very clearly in his great work Human Action: A Treatise on Economics. Here’s Mises:

There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.

What Mises was saying is this…

Once you go down the path of manipulating interest rates lower and printing new money from thin air, you necessarily sow the seeds of a future crisis.

If you keep going down that same path for too long, you’ll destroy the currency and wreck the economy beyond all recognition. This is the worst-case scenario.

But if you recognize that your current trajectory is unsustainable, you can make the decision to reverse course.

This will result in a painful economic contraction. Artificially low interest rates and funny money fuel all kinds of malinvestment… and that malinvestment must be liquidated.

That’s what the necessary recession does. It clears out the bad debt and gets rid of unproductive companies.

It’s not fun to go through. But it’s far preferable to destroying the currency and the entire economy.

Most of us in the alternative financial space assumed the Fed would never reverse course. But it did. The Fed chose Mises’ voluntary abandonment option when it set out on its rate-hiking campaign last year.

Now, this doesn’t mean the Fed is “good”. Let’s be clear about that. It is simply acting in its own best interest.

What we need to understand is that the Fed is normalizing interest rates. It wants to get back to what it calls the “terminal level”. That’s the rate at which the Fed sees as neutral. It’s neither stimulative nor restrictive to the economy.

When the Fed gets to that level, it will stop raising rates. But that doesn’t mean it will turn around and cut rates aggressively after. The game has changed.

Powell needs normalized interest rates to force fiscal responsibility upon the system again. That’s the only hope we have of getting back to a healthy economy.

And that means we’re going to endure a massive recession in the coming years. It’s unavoidable.

This is why we need a whole new approach to building our portfolio.

The Age of Paper Wealth is over. It’s not coming back. We need to bulletproof our money… before it’s too late.

To do so, we must focus on five core investment themes. They are:

- Reserve Assets

- World-Class Insurance

- Energy Renaissance

- Gold Equities

- Consumer Goods Inflation Hedges

We talked about reserve assets and world-class insurance last week. I see both as foundational.

We also discussed the coming energy renaissance… and how to get out in front of it yesterday. Doing so all comes down to learning the secret of energy royalties.

We’ll cover gold equities and consumer goods inflation hedges the next few days. Then we’ll talk about the obvious break between the Fed and the US Treasury. I haven’t seen this discussed anywhere else yet…

Stay tuned.

-Joe Withrow

P.S. The Age of Paper Wealth may be over… but that doesn’t mean doom is upon us.

The Phoenician League investment membership is where we put it all together to create a comprehensive plan for financial independence. You can find more information at:

Achieve Financial Independence Using an Ancient Investing Secret