When we left off yesterday, we were examining the idea that the Age of Paper Wealth had a devastating impact on traditional American society.

As a reminder, the US government cut the dollar’s final link to gold in 1971. This removed all restrictions on creating new dollars at will.

It took most governments about a decade to realize this… but they’ve been printing money in greater and greater quantities since 1982. This drove interest rates down to zero… and it propelled the US stock market to all-time highs.

I call this period from 1982 to 2022 the Age of Paper Wealth. It certainly seemed like a prosperous period in American history – and for some it was. But the combination of artificially low interest rates and printed money financialized the American economy.

That is to say – we emphasized financial markets, financial institutions, and financial activity to the detriment of hands-on knowledge, skilled labor, the middle class, and traditional American values.

Today, very few people seem to know how to do anything with their hands. Myself included. Finance is all I’ve known. But I am making an effort to get better about this.

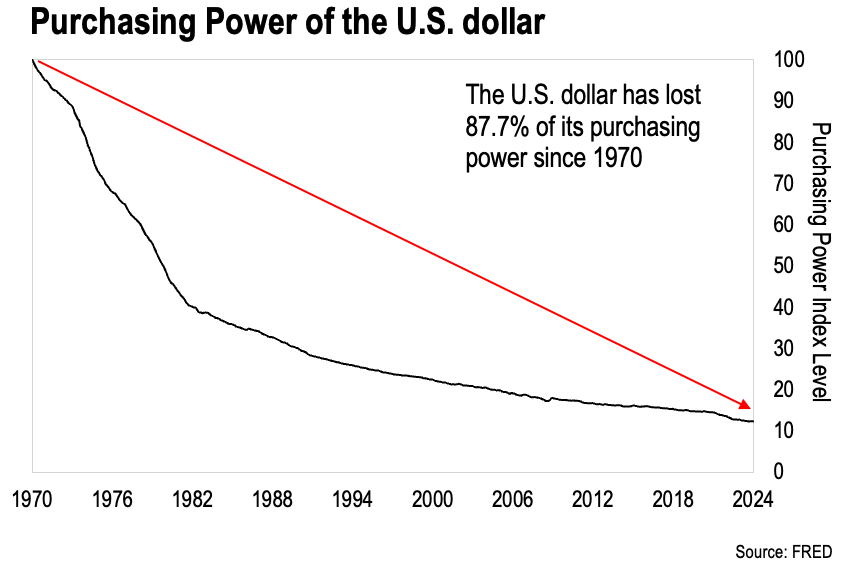

And look at what’s happened to our dollar…

This data comes directly from the Federal Reserve. Their own data shows that the US dollar has lost nearly 88% of its purchasing power since 1970. This is why nearly everything has increased in price dramatically.

And what’s the result of this?

The once robust American middle class has been hollowed out. Because the purchasing power they work so hard for is constantly stolen from them – but in a subtle way.

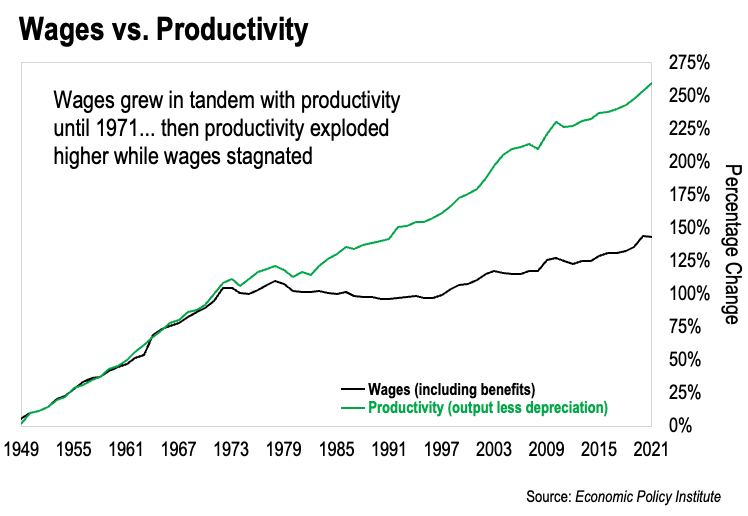

I have one more chart for you today to tell that story. Here it is:

This chart compares the growth in median US wages, adjusted for inflation, against total American productivity. The data spans from the late 1940s to the present day.

It’s clear that wages and productivity were in sync until 1971. The average person’s salary increased proportionally with America’s output of goods and services. Just as it should.

But look at what’s happened since. Our productivity powered forward… but our inflation-adjusted wages went stagnant.

Why?

Those trillions of dollars created from nothing siphoned purchasing power from everyone in the economy.

Remember, this data is measuring the real purchasing power of wages adjusted for inflation. If we look at nominal wages – they have gone up. In dollar terms, the median salary is higher than it’s ever been.

The problem is, those dollars buy just a fraction of what they once did. Because their purchasing power was stolen. That’s why we have to adjust for inflation.

And where does this stolen purchasing power end up?

In the hands of those who get to use the newly created money first.

Creating new dollars out of thin air effectively funnels most of America’s productivity gains to Washington, DC and Wall Street. That’s been happening for decades now.

This dynamic is why it has become so difficult to get ahead.

If we look at the data, the median price of a new car today is over $48,000. That’s what the median home cost back in 1980.

Think about that… today a regular new car costs just as much as what a nice single family home cost just forty years ago.

Then if we look at the median home price today – it’s over $430,000. Just for a nice single family home.

Of course, that number is skewed by real estate prices in the large cities. But at the same time, most young people live in the cities.

This begs the question – how can they afford a middle class lifestyle? And what does that say about the American dream today?

Then if we look at those approaching retirement – how do they grapple with the fact that our cost of living is streaking higher?

To me, it’s clear that the rules of money have changed. When it comes to personal finance, what worked so well in the past is not going to work terribly well going forward.

We need a new vision and a new approach to navigate the choppy waters we find ourselves in. And that will be our topic for tomorrow…

Stay tuned.

-Joe Withrow

P.S. Don’t forget we’re currently offering two in-depth special reports on money and investing. You can get more details at the bottom of our brand-new author page right here: https://joewithrow.com/