We’re pulling back the curtain on inflation this week… and it’s getting ugly. The middle class is getting wiped out.

And that’s not just an opinion. It’s all in the data. Today I’ve got two tables for you that spell it all out, clear as day.

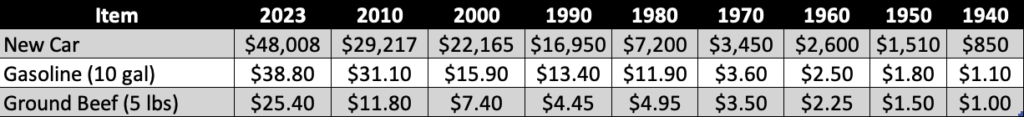

This table tracks the median price of a new car, ten gallons of gas to put in that car, and five pounds of ground beef going back to 1940.

As we can see, it’s not a pretty picture. Costs have risen dramatically over every ten year period in modern history.

That said, we have to compare these costs to the median income to get a better feel for the story. And that’s what this next table does:

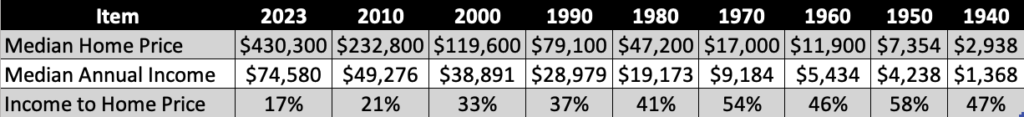

Here we’re tracking the median home price compared to median annual incomes going back to 1940.

And again, we can see that home prices have risen significantly over every ten year period. But incomes have too… so it’s that third line that we need to focus on. It shows us exactly what percentage of the median home the average guy’s salary can cover.

The median home costs $430,300 today. The median annual income is $74,580. That means the average person’s salary can only cover 17% of the median home price.

We can see just how dramatic this is by looking at past data. If we go back to the turn of the century, the median income could cover 33% of the median home price. That’s nearly twice as much.

Then if we go back to 1970—the median salary could cover more than half of the median home price. If that were the case today, the average person would be making $232,362 a year.

What these numbers illustrate is that it has become harder and harder to live a comfortable middle class life in the US. It’s all because inflation has eroded the value of our dollar… thus, costs have risen far faster than incomes.

And as we saw yesterday, there’s an even darker side to this story.

The American economy hasn’t faltered. We’ve increased productivity and output year after year. But those in charge of our monetary system purposefully redirected those productivity gains away from us and to themselves.

The good news is that there are ways to fight back. There are ways to leverage inflation and put it to work for us, not against us.

Our Finance for Freedom program will show you how. More information right here.

-Joe Withrow