by Jeff Clark – Hard Assets Alliance:

I want to congratulate you.

Gold and silver have been in a downtrend for over three years. And yet you’ve held on.

In spite of violent selloffs and a prolonged bear turn in the market, you’ve been patient. You see the big picture. You’ve steeled your emotions and rebuffed the negative mantra from the mainstream. You get it. You understand that sooner or later the fiscal and monetary path the world has embraced and praised won’t work.

And you will soon be rewarded. I can’t give you a date, but I can tell you it’s a question of when, not if.

How can I make such a claim?

History.

The Gold Market at Extremes

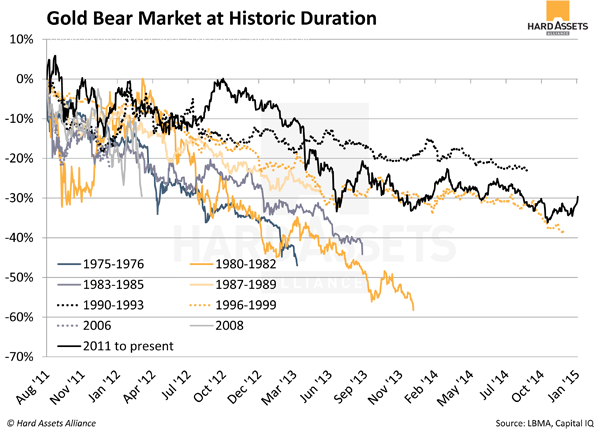

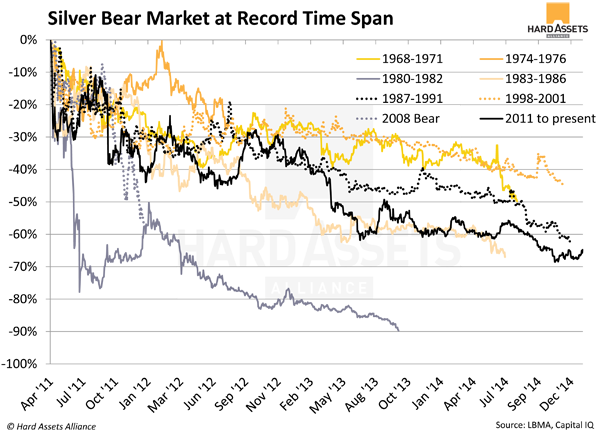

I measured the duration and degree of every bear market in gold and silver in modern history and compared them to our current situation. It’s quite revealing.

In each chart, the black line represents our current bear market. Here are the data for gold since the early 1970s:

Gold has endured deeper selloffs, but as you can see, it’s one of the longest on record. And if the price were to slip further and close below $1,142 (on a fix basis), it would officially be the longest bear market in modern history. I’ll also point out that gold declined 1.8% last year, making 2013/2014 the first back-to-back annual loss since 1997/1998.

Silver’s performance is even more dramatic. Since the 1960s, only one bear market has registered a bigger price decline, and only two were longer (assuming the bottom was $15.28 on November 6 last year).

These data all point to a bear market that has reached an extreme level.

That’s not to say prices can’t go lower, but history suggests that the end to the downtrend is close, if not already behind us. Your patience will soon get a vacation.

But does that mean the price is ready to take off again?

Gold Is Insurance, Not an Investment

While you can sell gold for a profit or a loss like any other investment, the most accurate way to view gold is as an alternate currency—the only one history has shown to provide monetary protection during a major currency devaluation. And the ongoing currency dilution around the globe today is comparable to some of the most notorious in history.

Yes, I think we’ll all make a lot of money in our HAA accounts. But gold’s primary role as insurance is more important right now.

Consider the risks we investors and consumers face:

• What if banks begin lending out the money the Fed has loaned them?

• What if the Fed decides it needs another round of QE, regardless of what they call it?

• What if interest rates rise, whether initiated by the Fed or pushed higher by the markets?

• What happens when—not if—the stock market enters a correction and mainstream investors begin losing money? What if the average investor remembers 2008 and decides to bail? How will the Fed react?

• What will be the mainstream reaction if the real estate market goes flat or reverses? How would the Fed respond?

• What happens if the economy legitimately grows—and kickstarts inflation?

• What happens if the debt load overwhelms the Fed’s printing efforts? Will they give up or double down?

• What if a developed country selectively or fully defaults on its debt?

• What if we reach a tipping point where other countries tire of the nonstop currency dilution and slow or reverse their treasury purchases?

• What happens if the markets lose confidence in the Fed or other central banks’ ability to manage their respective economies and markets?

• What if politicians don’t institute serious fiscal reforms, and Fed interventions are reduced to nothing more than monetizing deficit spending by causing inflation?

• How would global central bankers respond if deflation takes root?

• What happens if the geopolitical conflicts deteriorate and lead to war?

• What happens when—not if—control of the gold market shifts to China, away from North America?

The point is that we face increased systemic risk. Central bankers have painted themselves into a corner, and there is no easy exit from their policy mistakes. Since these issues have not been dealt with effectively, and political leaders show no sign of doing so, systemic risk has greatly increased. Sooner or later there must be a reckoning—the math doesn’t work, and history has demonstrated the outcome of such fiscal setups numerous times. Certainly, more caution is warranted than what most mainstream commentators suggest.

This is a major reason why I continue to buy gold and silver, and why I recommend you do, too. It’s not a speculation on rapid gains, but essential wealth insurance. In fact, the next bull market in gold will likely be spurred by one or more of the above risks materializing.

So instead of wondering if the gold price has bottomed, I recommend asking these questions:

• How much have you personally allocated to precious metals to offset the risk of a currency or similar crisis of major proportion? The need for monetary insurance against those risks is high, and rising. Given the elevated risk, a commensurate level of insurance is necessary. Fire insurance is designed to provide enough funds to rebuild your entire home, not just the basement. So one ounce of gold or one tube of silver won’t cut it.

• Does your portfolio stand on a foundation of mostly paper assets? If stocks and bonds comprise the lion’s share of your investments, your overall investment risk is very high.

• How correlated are your investments to the stock market? If mainstream investments decline, how will your overall portfolio be impacted? Gold and the S&P are typically negatively correlated; with both at extremes, now is a good time to make sure you strike the right balance.

• Have you stored some assets outside your political jurisdiction? The prospect of capital controls has grown.

In other words, it is less about the exact price and date of the bottom for this market and more about how you will protect yourself against the risks outlined above—they are real, in spite of what we read in mainstream headlines. If any transpire, they will wreak havoc on your investment portfolio and your ability to maintain your current lifestyle. That’s worth insuring.

In the meantime, the extreme nature of the current bear market means that current prices are a potentially life-changing opportunity.

Join me in creating bull market wealth—by taking advantage of current bear market prices.

Article originally posted in the January issue of Smart Metals Investor at HardAssetsAlliance.com.