submitted by jwithrow.

Journal of a Wayward Philosopher

How the Fed Destroys the Middle Class

January 15, 2015

Hot Springs, VA

The S&P opened at $2,013 today. Gold is up to $1,262 per ounce. Oil rallied back up to $48 per barrel. Bitcoin has dived to $216 per BTC, and the 10-year Treasury rate opened at 1.81% today.

The big news in the markets today comes from the Swiss National Bank which announced that they will abandon the Franc’s peg to the Euro. This move suggests the SNB is expecting Europe to ramp up its very own quantitative easing program in a big way. If that happens we can expect the U.S. dollar to strengthen, Treasury rates to continue their decline, and gold to rise in price. Such a move could also spark another bull cycle for gold miners in the equity markets. We shall see.

If you ask the media, they will tell you the economy is recovering quite nicely. They will tell you they are a little disappointed the recovery has taken this long, but a recovery it is nonetheless. And sure enough, the economic landscape does look better now than it did in 2009. If you live in a metropolitan area you may even be tempted to think the media is absolutely correct – happy days are here again! The stock market has boomed, mortgage rates are on the floor, and the banks are lending once again… what more could anyone ask for?

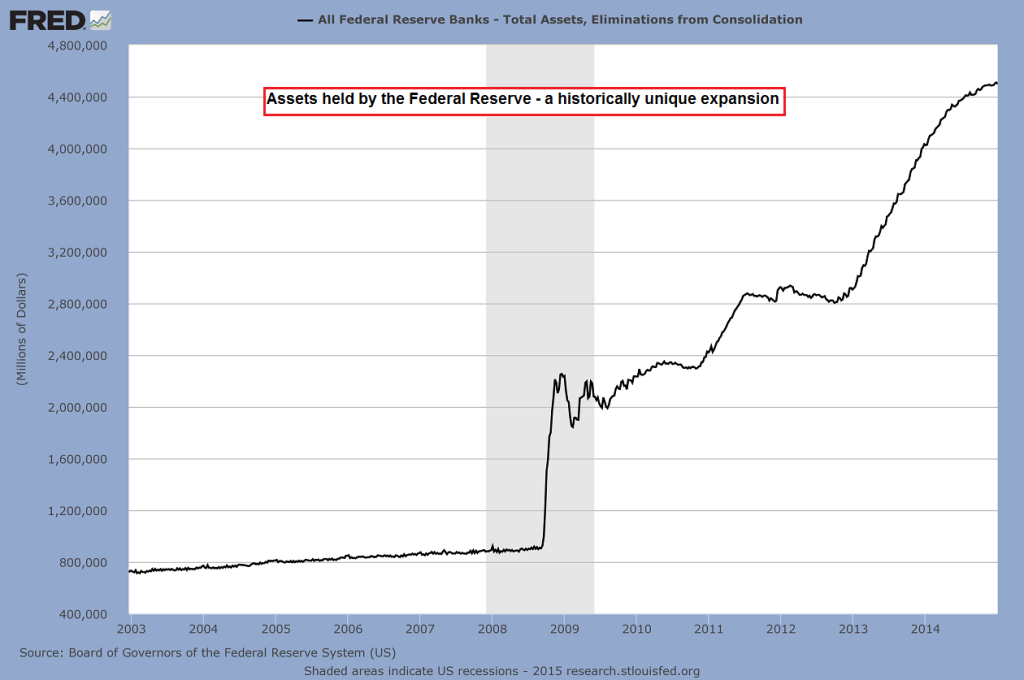

Regretfully, I must point out that whatever recovery has taken place is due exclusively to a credit expansion of historic measures. Take a look at this chart from the Fed’s Board of Governors.

The Federal Reserve’s balance sheet expanded from $890 billion ($890,000,000,000) to $4.5 trillion ($4,500,000,000,000) in just six years. This balance sheet expansion represents the acquisition of assets by the Federal Reserve – U.S. Treasury Bonds and mortgage-backed securities specifically. What this means is the Fed purchased bonds from the federal government to finance government deficits and the Fed purchased mortgage-backed securities from Wall Street to bail out the banks.

The Fed saved the day!

But we must ask – where did the Fed get the dollars to save the financial system? Well if you are familiar with our work on fiat money then you know the Fed created those dollars out of thin air. That’s 3.61 trillion ($3,610,000,000,000) extra dollars floating around in the financial system conjured into existence. Is it any wonder interest rates hit the floor and stocks boomed?

Go back and ask the media and they will tell you this is normal. The Fed did what it was supposed to do, they will say, it exists to manage the financial system. The media has had six and half years to feel confident in this assessment. But the Fed itself shows us what the problem is – the recovery is unsustainable!

Let’s go back and look at the chart. The Fed has classified the period from the end of 2007 to the middle of 2009 as a recession. The Fed shows how it printed $1.41 trillion during that time period and brought an end to the recession. But then the Fed kept on printing – in even greater quantities! If the recession ended in 2009, why did the Fed need to create another $2.2 trillion over the next five years?

The answer is clear as day and the Fed shows us why – the recovery is solely dependent upon exponential credit expansion. It’s game over as soon as the credit stops expanding.

The fact is no structural reforms have taken place within the financial system since the crash of 2008. All of the underlying problems are still present; they have simply been papered over by credit creation of historic proportions. As much as the media would have you believe otherwise, you just can’t cure a debt problem with more debt.

”Sooner or later everyone sits down to a banquet of consequences.” said Robert Louis Stevenson.

For those living outside of the major U.S. metropolitan areas, that banquet of consequences is here. Middle America has been hollowed out and small town U.S.A. has been destroyed by the fiat monetary system that has been employed since 1971. Income inequality has risen rapidly, not because of greedy capitalists, but because politically-connected institutions have been the recipients of enormous quantities of money and credit created from nothing. What is occurring is a wealth transfer of epic proportions.

It is the middle class that bears the brunt of this massive wealth transfer. As we mentioned in our first journal entry of 2015, the Cantillon Effect is in full swing. The individuals and businesses farthest away from the printing press have their wealth systematically transferred away from them to the institutions with their cup under the money spigot. Don’t believe me? Take a trip to K-Street and observe what goes on there.

Of course there’s nothing new under the sun. This dynamic has played out numerous times in various places throughout modern history. It always leads to the destruction of the middle class and then the destruction of the monetary system itself.

Fortunately, individuals can insulate themselves from some of the financial destruction if they understand what is happening. It is understanding that is the most difficult part.

Until the morrow,

Joe Withrow

Wayward Philosopher

For more of Joe’s thoughts on the “Great Reset” and the fiat monetary system please read “The Individual is Rising” which is available at http://www.theindividualisrising.com/. The book is also available on Amazon in both paperback and Kindle editions.