submitted by jwithrow.

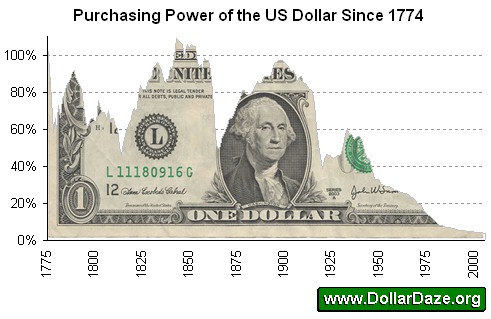

Most of us understand that inflation is a given in our world today… But not too many of us think about how inflation affects our income.

We tend to think of our income in nominal terms rather than in real terms because that’s what we can see. We can see the numbers. After all, nominal income is our income defined only by its dollar amount.

While this just seems like common sense, it’s not the real story. You can expose the flaw of nominal income when you compare it over periods of time.

Think about this. What if our income goes from $48,000 last year to $50,000 this year? That’s a 4% raise. Not too bad, right?

Well, let’s look at our income in real terms. Real income is income defined by its purchasing power. It is nominal income adjusted for inflation.

What if inflation rises to 4% this year?

Well, the means our $50,000 salary this year will have basically the same purchasing power as our $48,000 salary last year. In other words, we didn’t get ahead. Our raise wasn’t actually raise. That’s because our income did not go up in real terms… even though our paychecks were bigger.

That’s why it’s so important to see income in terms of purchasing power… Not in terms of nominal dollars.

The real story is that the American middle class has been stuck on a giant hamster wheel for decades now. Their paychecks keep getting bigger… But their purchasing power is destroyed by inflation. They are stuck.

This is why the Austrian School of Economics views inflation as an insidious tax. If nominal income kept pace with inflation then it would not be so bad. But wages have struggled to keep up with inflation since the early 70s.

Now, wages have done a decent job of keeping up with the Consumer Price Index (CPI). But this index has been adjusted several times to ignore food and fuel price increases. They fudge the numbers to make the CPI look better.

By the way, Social Security promises cost of living increases tied to the CPI… Retirees are getting a raw deal there.

This concept also exposes the retirement folly pushed by the financial services industry.

Have you seen those commercials about your “magic number”? They say you need a certain amount of dollars saved up for retirement to live securely off the income.

But if you think in terms of real income and purchasing power… It is impossible to pinpoint a magic number. Inflation will constantly eat into it. That’s why their magic number is just a carrot on a string.

So, the only way to truly take control of your own financial destiny is to think in real terms… And to recognize the nominal view of money for the illusion that it is.

P.S. Our Finance for Freedom course series pulls back the curtain on how money and finance really work. And it covers expert financial strategies to increase income, build wealth, and shatter the glass ceiling forever. Learn more at newly revamped https://financeforfreedomcourse.com/.