submitted by jwithrow.

Click here to get the Journal of a Wayward Philosopher by Email

Journal of a Wayward Philosopher

Markets and Economic Calculation

June 7, 2016

Hot Springs, VA

“Monetary calculation is not the calculation, and certainly not the measurement, of value. Its basis is the comparison of the more important and the less important. It is an ordering according to rank, an act of grading (Cuhel), and not an act of measuring.” – Ludwig von Mises

The S&P closed out Monday at $2,109. Gold closed at $1,247 per ounce. Crude Oil closed at $49.71 per barrel, and the 10-year Treasury rate closed at 1.72%. Bitcoin is trading around $585 per BTC today.

Dear Journal,

Wife Rachel and I will commemorate our third wedding anniversary tomorrow! When she asked me what I would like to do to celebrate, I naturally suggested that we could do anything in the world she wanted. Her response:

I would kind of like to do something fun, but I would settle for a major house cleaning day…

Does that mean we are officially marriage pro’s?

Moving on… I think this is a fascinating time to be alive. Based on what I know about recorded human history, I doubt there has ever been a more interesting point in time to be a keen observer of civilization. How lucky we are!

As I have reckoned on before, human civilization is currently transitioning from the Industrial Age and into the Information Age. Pre-Internet society was drastically different from post-Internet society, and indeed all of modern civilization has been made dependent upon a functioning Internet. This dynamic will only deepen as all of the Big Data and Internet-of-Things trends continue to play out.

While the Internet was a major inflection point, it was more-or-less integrated into the existing societal structure dominated by State power and centralized methods of social organization. I suspect we are speeding towards a second inflection point that very well may spawn structures, systems, networks, and organizations capable of bypassing the State-centric societal model. Maybe Bitcoin, Blockchain technology, and decentralized autonomous organizations (DAO) will be the catalyst.

I have been speculating quite a bit about the future in these journal entries recently, and every now and then someone calls out my soothsaying. “No one can predict the future!”, they say.

And I absolutely agree. The future, as far as I know, is unknowable – but it isn’t completely random either. We can observe the trajectory of prominent macroeconomic trends to get a general idea of future possibilities… assuming we are correct in our assessment and understanding of the observed trends.

Here’s the thing: the future will be directed by what works. If we see something that doesn’t work then we can reasonably project that it won’t exist at some point in the future. Conversely, if we see something that works extremely well then I think it has a great chance of being a prominent factor in the world of the future. I feel very comfortable with these statements, but I will add that the timeline for change seems impossible to project.

Which brings me to the next point of interest. Simultaneous to the expanding Information Age trends, we are rapidly approaching the end of the road for the current monetary system. With the break from gold in 1971, the global monetary system became an entirely different animal from that which had existed for most of civilized society previously.

It’s not very difficult to see that the fiat monetary system brought with it one-sided trends. All one has to do to confirm this is look at the data for the global reserve currency: the U.S. dollar.

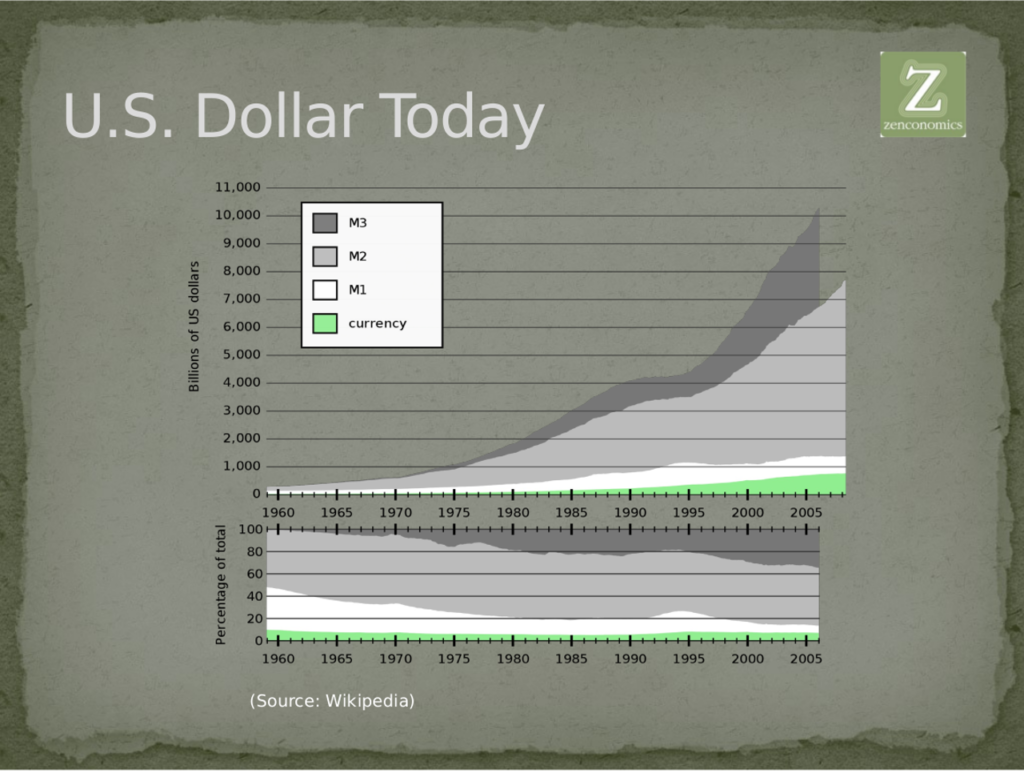

The money supply has absolutely exploded since 1960:

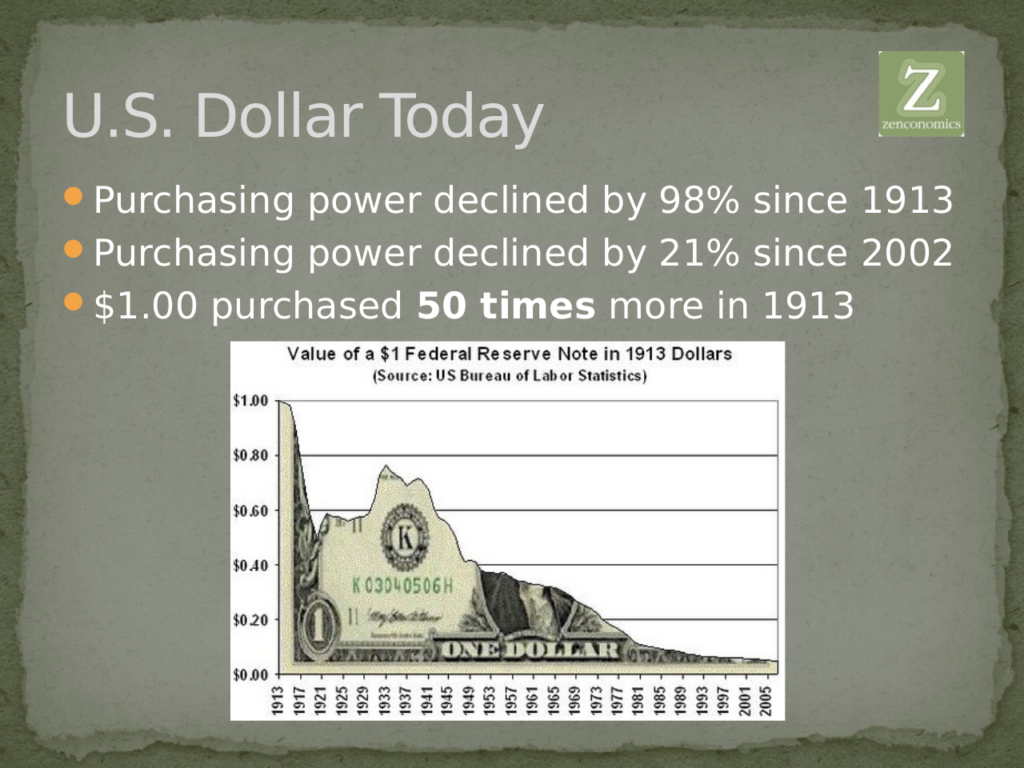

Purchasing power has declined significantly as a result of this monetary expansion:

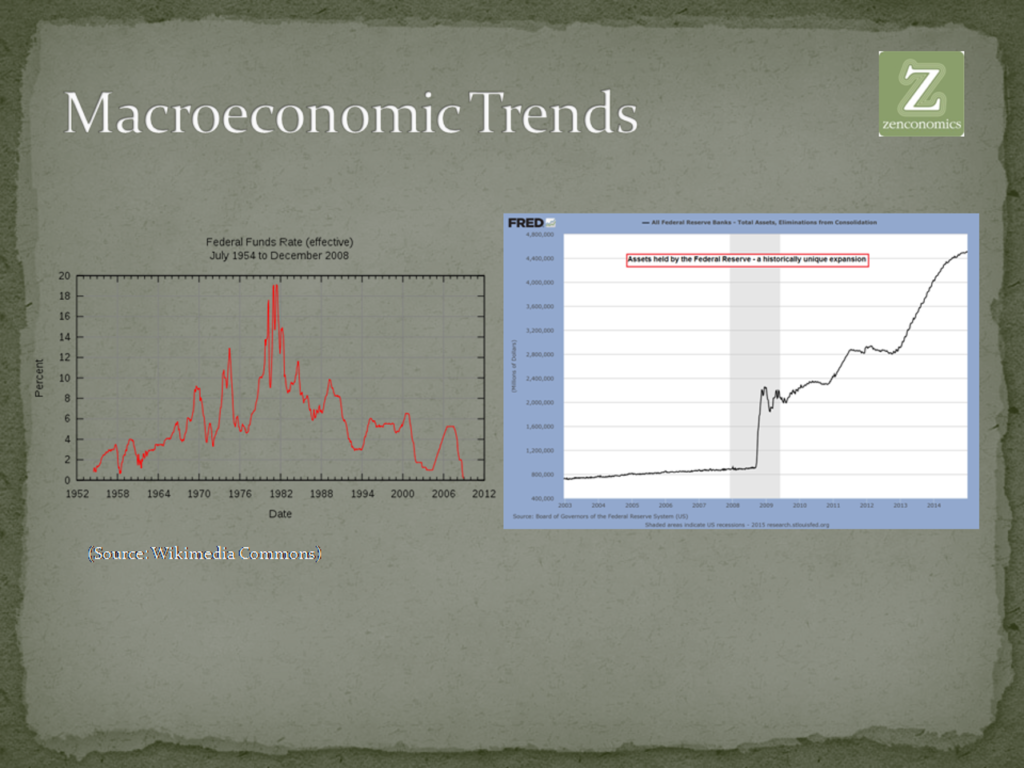

Interest rates have been declining steadily since the early 80’s, and they have been held at zero in the U.S. for more than seven years now thanks to the Fed’s interventions:

It doesn’t take much more than a basic understanding of economics and a little common sense to realize that these trends will not continue forever. One day these trends will reverse… although you can count on the “authorities” to fight off that day with everything they have. When that day comes, it is pretty easy to intuit that the massive public debt and unfunded liabilities which have accrued under this easy-money system will not be serviced honestly.

That’s a pretty bearish reality which keeps me up some nights. I don’t know exactly how much of the economy has become dependent on government liabilities, but I suspect it’s a very significant portion.

What happens if all Social Security beneficiaries and welfare recipients see their monthly benefits drastically reduced in terms of purchasing power? In other words, what happens if across the board a $1,200 benefit only buys $600 worth of goods and services?

I am very very concerned about this possible future.

But then other nights I think about all of the liberating technologies, systems, and networks currently in development and my perspective shifts to bullish.

It’s a tale of two cities in many ways.

As if this all weren’t interesting enough, a craft beer revolution – likely fueled at least in part by cheap credit – has placed some really interesting brews into the hands of philosophers, observers, and Bernie Sanders supporters everywhere. You can’t really appreciate the beauty and complexity of human civilization until you’ve done so with a “Dogfish Head” IPA in your hand.

There is one other fascinating societal dynamic that I observe and ponder with my Dogfish friend in hand, and that is the modified and modernized resurgence of Marxism in the western world.

Unlike the 19th and 20th century version Marxism, the modernized Marxists do not seem to advocate pure socialism including overt nationalization of the means of production or the abolition of private property. Instead, they seem to advocate increased taxation, regulation, wealth redistribution, and wage/price controls while pointing to the major wealth disparity between the power elite and the average worker as justification for government intervention.

They don’t seem to want to kill off private sector commerce, but they certainly advocate more centralized top-down control when it comes to social organization and the allocation of resources. Thomas Pikkety probably deserves a great deal of credit for the modernized Marxist revival.

I don’t think many people outside of Academia actually believe in socialism as an economic model anymore. Even the professed “Democratic Socialist” running for President in the United States doesn’t actually believe in socialism per its true definition. Professed socialists, including Mr. Sanders, would probably be better labeled – not that I particularly care for labels – as ‘New’ New Dealers.

What seems to be missed here is the verifiable fact that most of the wealth disparity that currently exists between the power elite and Main St. is due exclusively to the fiat monetary system and inflationary abuse by governments and central banks.

Scroll back up and look at the monetary expansion chart – all of that money had to go somewhere. And that “where” was government, their favored institutions (Wall Street, Defense Contractors, etc.), and special interest groups. The cronies closest to the new money that flowed to these institutions are the people who are now fantastically wealthy despite providing very little of value in return.

That’s not pure capitalism in action, and it’s certainly not a facet of the market system. It’s institutionalized theft and corruption. Further squeezing the market economy and shifting more power and wealth to the State will augment the problem, not solve it.

Markets work because they are a tool for economic calculation and the effective allocation of resources. Markets are not a tool for exploitation, as the Marxists suggest, but rather they are a tool for human progress.

The only way for a business to be successful in the marketplace is to provide satisfactory goods and/or services to people who want them. People do not purchase goods or services they don’t want, nor do they purchase goods or services that fail to meet their quality standards… at least not after reputations have been determined.

Profit is the measure of success. A business must be profitable to be successful, and it can only be profitable if it satisfies consumer needs and wants in a satisfactory way. In effect, and assuming no outside intervention, profits align the interests of business owners with the interests of consumers. The businesses that harm or defraud people will go out of business very quickly in a true market economy, thus minimizing their negative impact. There would be no subsidization or bail-outs for defunct businesses of questionable integrity.

Profits are determined by the price mechanism which ultimately determines how resources are allocated. Markets are not places where prices are ‘set’; they are places of constant price discovery.

Despite what the central bankers say on television, market corrections are necessary and welcomed features of a market-based system because they curtail shortages and surpluses. When something is scarce in availability but high in demand, human actors in the marketplace will value it very highly thus its price will be high. The businesses operating in that industry will derive substantial profits due to the high price which entices other entrepreneurs to launch competitive businesses in the same space. Typically this serves to increase availability over time which results in lower prices and ultimately lower profits which tends to deter marginal producers and entrepreneurs from allocating anymore resources to the particular industry.

Such is the self-regulating feature of the market system. Markets work because they auto-correct for scarcity, surplus, and demand via the price mechanism and the profit motive. The more markets are free to direct resources to areas of high demand, the more prosperous a civilization will become. Coincidentally, the most prosperous civilizations throughout history are always the most peaceful as well.

I tend to think that most people want peace and prosperity, at least for their self and their family. Some days I worry that this is the thought of a naive idealist as I have encountered a few people over the years who seemed to only want conflict and destruction. But then a story of amazing human achievement will come to my attention and my faith is restored.

Such is just the nature of human civilization, I suppose. The book of Matthew advised on this very dynamic some 2,000 years ago: Give not that which is holy to dogs; neither cast ye your pearls before swine, lest perhaps they trample them under their feet, and turning upon you, they tear you.

So assuming most people actually want peace and prosperity, a market-based society in which people are free from top-down control is the best road to get there. Markets work specifically because they enable economic calculation and efficient allocation of resources. U.N. commissions, congressional committees, communal politburos, and other top-down structures all fail because they make calculations and allocation decisions based on arbitrary judgment and politically-based opinions.

What’s beautiful about this is the fact that it is 100% in line with the Golden Rule and the core tenets of western civilization. Don’t kill. Don’t steal. Don’t harm others. Respect the property of your neighbors. Honor your contractual agreements. These are the rules of a market-based system.

Governments may claim to stand for these same things with egalitarian rhetoric mixed in, but in reality they are the largest sponsors of murder, theft, destruction, fraud, deceit, inequality, and cronyism the world has ever known.

I know such a statement upsets the apple cart, but I don’t see how this can honestly be refuted.

Governments across the globe killed hundreds of millions of people over the course of the 20th century. In the U.S. alone governments confiscate roughly $4 trillion from the people they allege to serve every single year. They pass arbitrary laws for victimless “crimes” by the thousands annually, and they will send agents with guns to arrest you if you fail to comply with their edicts. All across the globe, governments and central banks create trillions in new money every single year and they use this money to expand their power and wealth at the expense of everyone else.

In addition to the horrendous moral implications, all of this cronyism and State intervention gums up the wheels of commerce, destroys the purchasing power of the currency, and renders human civilization less wealthy and far less advanced than it otherwise would be.

If you ever sit up at night wondering about what happened to the “good old days”…. there’s your culprit. Markets and decentralized networks are your answer.

More to come,

Joe Withrow

Wayward Philosopher

We have just released the Zenconomics Guide to the Information Age to members of the Zenconomics Report email list. This guide is 28 pages in length, and it discusses: money, commerce, jobs, Bitcoin wallets, peer-to-peer lending, Open Bazaar, freelancing, educational resources, mutual aid societies, the Infinite Banking Concept, peer-to-peer travel, Internet privacy, and numerous other Information Age tips and tricks with an eye on the future. We are offering a free copy to all new mailing list subscribers at this link: http://eepurl.com/bXyrQ1.