The investing game just changed.

A gentleman writing under the pen name Adam Smith wrote a book called The Money Game back in 1967.

Smith put forth the idea that investing in the stock market is an exercise in mass psychology. He pointed out that most investors have no clue how to value stocks… thus, they are not likely to ever make any money in the market.

But that’s okay. Because according to Smith, they aren’t there to make money. They just want to play the game. If you understand that, you’ll realize that the mood is what drives everything.

And Smith pointed out that greed and fear are the two primary emotions in the market. At any given time one of them is likely to be in the driver’s seat.

It’s a great read. But it concludes rather curiously.

Smith wrapped up the book by talking about the prophets of doom. He called them the Gnomes of Zurich.

These are the people who constantly think the market is about to crash and the game is about to end. Many of the early pioneers in the financial newsletter industry fit that bill.

The problem with the doomsday prophet is that he always imposes his bias upon his forecasts. And he brings morality into the picture.

But just because something is wrong… and just because something can’t last forever… doesn’t mean its end is imminent.

That’s why so many editors in this business got burned trying to call the top at one point or another. They didn’t wait for the signal. They didn’t let the data tell them when the jig was up.

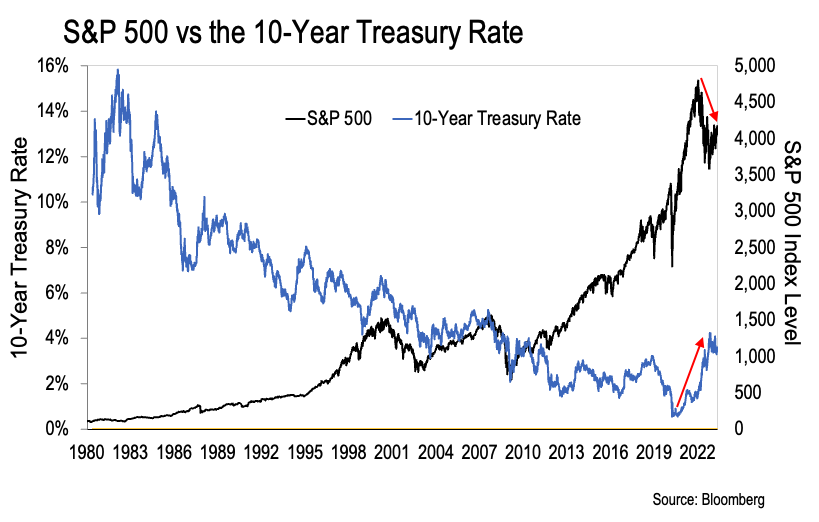

Well, we now have that signal. This chart tells the story:

Here we can see the S&P 500 and the 10-year Treasury rate going back to 1980. The S&P 500 is the black line. And the 10-year Treasury rate is the blue line.

We’re using the S&P 500 as a proxy for US stock prices. And we’re using the 10-year Treasury as a proxy for interest rates. This chart makes it perfectly clear that the two are inversely correlated.

Interest rates started falling in 1982, and they fell consistently for the next 40 years. Meanwhile, US stocks consistently went up in value over that same time period.

But everything reversed in 2022. Rates started going up, and stock prices started to fall. We can see those moves clearly marked by the red arrows on the chart above.

When we zoom out like this, it’s no surprise that stocks fell hard when rates started to rise in 2022. But it sure caught a lot of people by surprise.

In fact, many financial analysts spent months trying to convince themselves and their clients that these moves were temporary. Just wait for the Fed to pivot, they said. Then we’ll get back to normal.

But here’s the thing—what happened from 1982 to 2022 was not normal. Nor was it organic.

Instead, it was all driven by the debasement of our money.

The US government and the Federal Reserve (the Fed) worked hand-in-hand to create over $8 trillion dollars from thin air during this time period. We can verify that $8 trillion because it hit their balance sheet.

There’s also strong evidence that the Fed collaborated with other major central banks to create over $20 trillion off balance sheet in the wake of the 2008 financial crisis. We can’t easily verify this. And at the end of the day it’s not important to do so.

What’s important to understand is what happens next.

End of the Road

Fed Chair Jerome Powell explicitly stated that he intends to kill the “Fed Put”.

This term refers to the fact that the Fed has always stepped in and goosed the markets with cheap money going back to 1987. That cheap money flowed into financial assets, pushing prices higher again.

Those days are over.

That is, if we believe Powell is serious about this.

We can’t ignore the fact that for the last forty years the US government has constantly pressured the Fed to cut interest rates and pump cheap money into the system. And since Paul Volker resigned in 1987, every single Fed Chair has succumbed to this pressure.

Will Powell resist? Danielle DiMartino Booth suggests that he will indeed.

Booth is both a Wall Street veteran and a Fed insider. She began her career on Wall Street, and then she spent nine years at the Federal Reserve Bank of Dallas. There, she served as an advisor to Dallas Fed President Richard Fisher.

Today DiMartino Booth is the founder and CEO of a research firm called Quill Intelligence. And she still has some connections within the Federal Reserve System. Those connections give her a more nuanced understanding of what’s happening behind closed doors at the Eccles Building.

In a recent interview, Booth made it clear that there tends to be a bureaucratic echo chamber at the lower levels of the Fed. Here’s what that means…

We see the Fed Chair when they go on television and when they are quoted in news articles. But what we don’t see is the underlying team of people who feed research and analysis to the Chair. That team tends to consist primarily of academic researchers.

According to Booth, Powell’s comments on inflation being transitory in 2021 were based on the analysis he received from academic researchers within the Fed.

Obviously that analysis was completely wrong. It left Powell with “egg on his face,” as Booth put it in the interview.

She went on to explain that this incident woke Powell up to the fact that there was an academic echo chamber within the Fed. Ever since then Powell has been looking to “outside” data and analysis to guide his decisions.

Booth didn’t elaborate on this point, but I think it’s a safe assumption to say that this “outside” analysis has come from Powell’s network within the upper echelon of the New York banking scene.

Then Booth pointed out the difference between Powell and his predecessors Janet Yellen and Ben Bernanke.

I’m reading between the lines a little bit here, but Booth seemingly suggested that Bernanke was something of an “empty suit” academic. She didn’t use those exact words, of course. But she implied that he simply went along with whatever academic research was popular at the time.

Booth also implied that Yellen, while purely an academic, is also something of an idealogue.

Yellen fancies herself as a globalist progressive. She fervently believes that the global elite know what’s best when it comes to how to manage society and keep the common folk in line. Those are my words, but Booth’s comments seem to support that idea.

Jerome Powell’s different. He’s not an academic. He’s a Wall Street veteran. He has direct experience in the financial markets. And he built a net worth in excess of $100 million.

That also sets him apart from Bernanke and Yellen. They both made their money after becoming Fed Chair.

So, we should ask the important question: what motivates Jerome Powell? What are his incentives?

For Bernanke and Yellen, they knew they would get paid handsomely if they did what the establishment wanted them to do. Book deals… six and seven figure speaking fees… overpriced consultations—there are plenty of ways to reward lackeys for good behavior.

But Powell doesn’t need their money. So, what’s he after here?

Booth offered her opinion directly. She thinks that Powell sees himself as serving his country.

She also explained that Powell was very critical of the Fed’s prolonged zero-bound interest rate policy. He tried to warn Fed officials that the longer they kept rates at zero, the harder it would be to unwind that policy.

If we look at what Powell’s said and what he’s done since 2022 – it all matches up.

Powell is dead set on normalizing interest rates and allowing a massive recession to come. He’s even talked about the need to clear the economy of a decade’s worth of malinvestment. It’s almost like he’s been reading the great Austrian economists recently…

So what’s it mean for investors?

Friends, we’re at the end of the road. We’re entering a new era.

For the last forty years the Fed has forced interest rates lower to juice the markets. Nobody under the age of 60 has been an adult in a world where interest rates didn’t constantly fall.

In that world, all you had to do to make money was buy some growth stocks and let them sit for years, maybe decades.

That’s not the play going forward.

It all comes down to what Adam Smith talked about in his great book. Are you here to make money? Or are you here just to play the game?

If you’re here to play the game, just keep doing what you’re doing. The next few years promise to be exhilarating.

But if you’re here to make money, you’ll need to completely overhaul your portfolio. I’ll tell you how tomorrow…

-Joe Withrow

P.S. For a much deeper dive into what’s playing out in the markets and the economy today, check out my new book. It’s titled Beyond the Nest Egg, How to Be Financially Independent Outside of a Broken System.

You can find it right here.