We’ve been talking about what’s been happening on the macroeconomic stage all week. Today, let’s take a step back and assess how we got here… and where this is all headed.

For the last thirty years the Federal Reserve (the Fed) has consistently pumped cheap money into the financial system. That’s driven everything.

In total, the Fed has created at least $8 trillion from nothing. That’s what we can verify. And there’s a good chance the Fed engineered even more new dollars through back-channels.

This onslaught of money created from nothing drove interest rates down to near-zero.

Then the commercial banks pyramided credit on top of these trillions of dollars by roughly ten-to-one. In other words, for every new dollar created, the banks could lend out ten dollars out against it. That means the banks created trillions of dollars from nothing as well.

This dynamic created a massive financial bubble in the U.S. and many developed countries around the world.

Meanwhile, major western governments used this funny money to spearhead massive spending programs. They created programs for pretty much anything and everything.

The most obvious spending circled around military and welfare-state programs. But a quick Brave search (search.brave.com) for “most ridiculous government spending programs” will reveal all kinds of other shenanigans. It’s mind-blowing what these people have done.

As a result, many regular folks have been conditioned to see government as this great cornucopia.

Whenever there’s a problem, somehow our society has adopted the idea that it’s government’s job to fix it. And given its seemingly infinite resources, government has been quick to acquiesce.

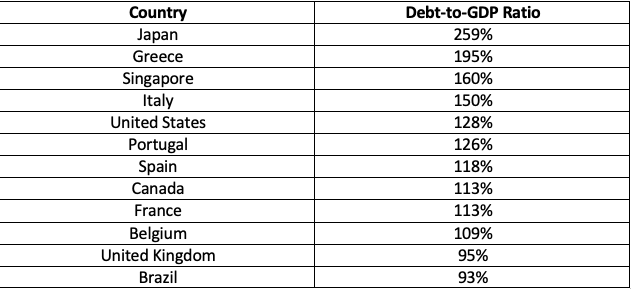

That’s why all western governments are now drowning in debt. Name any major western country and we can be sure that its debt-to-gross domestic product (GDP) ratio has ballooned in recent decades.

Many countries now service a debt that’s near or greater than 100% of their GDP. To illustrate this, here’s an abbreviated list of debt-to-GDP by country as of the end of 2022:

These numbers are unprecedented. Never before have so many countries run up a debt that equals or exceeds their gross domestic production.

This is only possible in a world where central banks can create new base money from thin air. And that world has only existed since 1971. That’s when U.S. President Richard Nixon removed the dollar’s final link to gold.

But it appears we’ve reached the limit. We’ve come to the point where the economy simply cannot handle any more debt and cheap money.

The problem is, there’s no easy fix to this mess. The great Austrian economist Ludwig von Mises spelled out the dilemma very clearly in his masterpiece Human Action: A Treatise on Economics.

Here’s Mises:

There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.

What Mises was saying is this…

Once you go down the path of manipulating interest rates lower and printing new money from thin air, you necessarily sow the seeds of a future crisis.

If you keep going down that same path for too long, you’ll destroy the currency and wreck the economy beyond all recognition. This is the worst-case scenario.

But if you recognize that your current trajectory is unsustainable, you can make the decision to reverse course. This will result in a painful economic contraction.

Artificially low interest rates fuel all kinds of malinvestment. And that malinvestment must be liquidated.

That’s what the necessary recession does. It clears out the bad debt and gets rid of unproductive companies.

It’s not fun to go through. But it’s far preferable to destroying the currency and the entire economy.

And this is what the battle between the Fed and the globalist power structure is about. The two factions have different preferences for how to move forward.

The globalist elites went all-in on their “Great Reset” plan.

As we discussed, they want to restructure the mechanisms of money and credit. They want central banks to be the ultimate arbiter of everything related to finance. And they want these central banks beholden to international organizations that they control.

That is to say, the globalists want to get rid of national sovereignty in everything but name. That’s why they have been trying to attribute arbitrary powers to their organizations.

For example, how many times have we heard proclamations from the World Health Organization (WHO) and the Centers for Disease Control (CDC) in recent years?

They’ve tried to position the WHO and the CDC as healthcare authorities. It’s all about conditioning the public to see their organizations as authority figures.

But here’s the thing – their reset can’t happen with the commercial banking system in place.

The banks control the engines of finance… and they are fiercely competitive. They aren’t going to finance the uneconomical elements of the Great Reset. We talked about that yesterday.

So the globalists want to usurp the banking function and get rid of the banks. That’s what this is all about.

Again, the Fed is a private entity. Nobody knows for sure what its aggregated ownership structure looks like.

What we do know is that it was the major New York banking interests who colluded with a prominent U.S. senator to establish the Fed back in 1913. It stands to reason then that the New York banks still own and control the Fed today.

That said, there may have been power struggles within the Fed itself.

Former Fed Chairs Ben Bernanke and Janet Yellen are absolutely in league with the globalist power structure. Bernanke’s more of a useful academic. But Janet Yellen is unapologetically in favor of the globalist plot.

So when these two ran the Fed, it catered to globalist interests.

Current Fed Chair Jerome Powell is in the New York banking fold. That’s why President Biden tried to find an excuse to not reappoint Powell for another term in 2021.

I don’t know how control of the Fed shifted back from the globalists to the New York banking faction. Perhaps there was an internal struggle. Or perhaps the two simply shared similar interests during the Bernanke and Yellen years. I’m not sure.

But what I do know is that the New York banks aren’t about to give up their commercial banking system. That is precisely why the Fed raised interest rates so aggressively last year. And it’s why they kept going even with the world yelling at them to stop.

Of course, inflation was the cover story. But the Fed isn’t raising rates to fight inflation. It’s all about curtailing the globalists’ ability to finance projects related to the Great Reset.

What’s more, the Fed’s actions guarantee that we’ll have a massive recession in the U.S. and Europe.

Those who can’t see what economists call second-order effects will decry this as a bad thing. But recessions aren’t bad. They are necessary.

Recessions clear out the bad debt and malinvestment. That paves the way for a healthy economic recovery. This must happen if we want small business and the middle class to thrive.

So to sum up: there are two ways forward right now.

The first is a reset. We could declare a debt jubilee and restructure the entire financial system.

The second option is to clean up our mess. We can welcome a massive recession that clears out the current imbalances… and then we have a chance to get back on solid footing.

The globalists prefer option A. The Fed and the New York banks want option B.

And because the power, wealth, and influence of each faction hangs in the balance, they are both willing to fight tooth and nail for what they want.

This is going to be a long, drawn-out slugfest. No doubt momentum will shift back and forth at times.

That said, the Fed and the New York banks have the upper hand right now. We’ll see if they can hold it…

-Joe Withrow

P.S. Sorry I got a little long-winded today. I probably should have broken today’s piece up into two separate e-letters. But we’re going to move on to a new topic next week… and I didn’t want to leave any loops open.

For those who don’t care much for this kind of macro talk, we’ll get back to having a more light-hearted discussion next week. I’ll see you on Monday afternoon.

And for those who find all this stuff fascinating like I do, we are tracking this financial war every month in much more detail within our investment membership The Phoenician League.

If you’re interested in learning more about what we’re doing with the membership, please sign up for our wait list right here:

The Phoenician League Wait List

We’ll be opening our doors to new members soon.