We’re talking about the investments that form an all-weather portfolio in the current macroeconomic climate this week. The idea is that we can allocate a little chunk of money to these investments every time we get paid to automate a system for building wealth.

As a reminder, the seven areas that I think are worth considering today are:

- Bitcoin

- Gold

- World-Class Insurance Stocks

- Top-Tier Energy Stocks

- Gold Royalty Stocks

- Consumer Inflation Hedges

- High-Technology Stocks

Please note that I’m omitting investment real estate and other income-producing assets here. That’s only because we can’t buy those assets in small increments. They require a larger commitment. And we should only consider them after we’ve built a strong financial base – which is what this consistent wealth strategy will do for us.

We discussed our first four investment themes in previous issues. You can access those by clicking the links above. As for today…

The legacy financial system is fracturing right before our eyes.

Here in the United States, our government has run up a national debt that’s greater than $34 trillion. That alone is an unfathomable amount of money. You and I couldn’t come close to spending $34 trillion in our lifetime.

Even worse, much of this debt is short-term. In fact, roughly 40% of the federal debt is coming due over the next three years. That’s somewhere around $13 trillion.

Obviously the US government can’t pay this debt off outright. It’s set to run annual deficits well in excess of $1 trillion per year over the next ten years.

That means the debt coming due will need to be rolled over. The Treasury will need to issue new bonds to pay off the old bonds.

This practice of rolling debt forward has never been a problem before. But that’s only because interest rates fell consistently from 1982 to 2022.

That enabled the Treasury to issue new debt at lower and lower rates… which in turn kept debt service costs low. Up to this point the interest payments owed on the debt have been manageable.

To quantify this, the average interest rate on the US government’s outstanding debt is just under 3%. And the Treasury spent $659 billion on net interest costs last year.

But the days of ever-lower interest rates are over.

As I write, the 2-year Treasury bond yields just under 5%. That’s the interest rate the US Treasury would need to pay on new short-term debt going forward.

And that means the US government’s net interest costs are going much higher.

The Congressional Budget Office (CBO) projects that interest expense will be the second biggest line item on the federal budget in 2025. That’s second only to Social Security and Medicare.

This sets the stage for a massive budget crisis. As the interest expense rises, the US government will either need to cut spending in other areas or it will need to borrow and print more and more money.

Meanwhile, the debt problem isn’t specific to the US. Name any major western country and you can be sure that its debt-to-gross domestic product (GDP) ratio has ballooned in recent decades. In fact, many countries now service a debt that’s near or greater than 100 percent of their GDP.

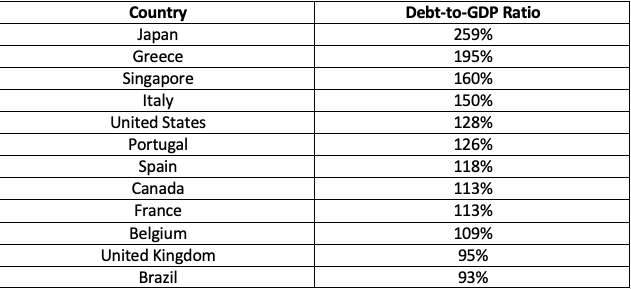

To illustrate this, here’s an abbreviated list of debt-to-GDP by country as of the end of 2022:

These numbers are unprecedented historically. Never before have so many countries run up a debt that equals or exceeds their gross domestic production.

This is only possible in a world where central banks can create new base money from thin air.

And I believe this is why central banks have been buying gold hand-over-fist in recent years, as we discussed last week. They know the days of printing fiat money from nothing are numbered. Because public trust is evaporating.

And that brings us to a big investment opportunity…

Gold Royalty Stocks

If we find ourselves in a world where trust in government currency fades and central banks look to back their systems with gold again to restore confidence – what do we think would happen to the price of gold?

It would go much higher, much faster than expected. This is why I believe the stage is set for a continued bull run in gold over the next several years.

These macroeconomic conditions (along with geopolitical tensions) are now in the driver’s seat when it comes to gold’s price. We’ve seen that clearly with gold breaking out to new all-time highs above $2,300 even as interest rates moved higher.

And that means it’s time to build exposure to the best gold equities on the market.

We discussed the need to own physical gold when we talked about reserve assets last week. Building some exposure to gold equities as well can add some real pop to our gold holdings.

I’m most partial to the best gold royalty companies right now. These are firms that finance gold mining companies. They provide the capital necessary to go out and build new gold mines.

In exchange, royalty companies receive royalty and streaming rights on all gold produced from the mines they finance.

In other words, royalty companies get paid for the work the mining companies do. As such, royalty companies have far fewer operating costs than gold miners.

That makes their income far more stable… especially as they build diversified portfolios of royalty and streaming rights across many different mines in operation.

This allows gold royalty companies to pay consistent dividends. We can reinvest those dividends to put the power of compound interest to work for us.

Here’s what I love about gold royalty stocks, as opposed to gold mining stocks:

Low operating costs: A gold royalty company’s primary expense is the cost of financing. And this is often a one-time upfront cost. Then the royalty company generates passive income from all future production.

Scalability: The royalty business model allows the company to scale its operations simply by acquiring new gold royalties and streams over time. The company doesn’t have to find or develop the mines itself. All it has to do is strike a royalty deal with those mining companies who do.

Diversification: The company’s diverse portfolio of gold royalties provides exposure to various geographic regions and mining companies. This reduces the impact of any single mine’s performance on the company’s overall results.

Cash flow predictability: A royalty company’s cash flow comes from long-term royalty and streaming agreements. These are rigid contracts that spell everything out up front. That allows management to predict future cash flow with a reasonable degree of certainty. And this makes it easier to plan for future growth and investments.

Relative capital efficiency: Royalty companies do not need to invest heavily in mining operations or other capital-intensive activities. This allows them to allocate capital more effectively and focus on acquiring new assets to grow their portfolio.

Inflation resistant: Because this primary business is financing, it’s largely insulated from inflation. That’s because royalty companies do not have a costs of goods sold expense that will increase with inflation.

Consistent dividends: All of these factors enable royalty companies to pay a regular dividend. The dividend yield won’t wow us… but it allows us to gradually compound our investment over time.

As with all stocks, the key is to only buy the best gold royalty companies when they are trading at attractive valuations.

-Joe Withrow

P.S. Have you heard of The Purple People?

They were an ancient tribe that left a legacy of innovations that we still use today. And they passed down an ancient business and investing secret that still applies to our modern world.

I’ve studied this secret extensively… and I can say with confidence that it works. I’ve used it myself.

If you would like to learn more about this ancient tribe and how to use their secret, just go here.