submitted by jwithrow.

This list is certainly not comprehensive but it is our hope that it serves as food for thought.

1. Become money-conscious

Before you can begin to create self-sufficiency and build wealth, you must become money-conscious. Wealth does not come to those who are careless or lazy and it does not come overnight with a stroke of luck. You must begin to recognize that nearly everything that you do has an impact on your self-sufficiency and accumulation of wealth. You must begin to recognize the rules of the universe as it relates to money. And you must begin to take action immediately. Begin to track your expenses tirelessly and eliminate unnecessary spending where possible. This does not require you to become “cheap” but it does require frugality. Once you become money-conscious you will identify ways to reduce your expenses and you will free up additional income to use towards the attainment of self-sufficiency.

2. Consider contributing to a 401(k) if your employer matches your contribution

After assessing your income and expenses and getting your financial house in order, consider contributing to a 401(k) up to the employer match percentage each month. It is important to review the vesting requirements (time of employment required before you can cash out the matching contributions) and determine whether or not you will be at this company for that length of time before deciding to contribute to the plan. The employer match will serve to multiply your deferred savings and your 401(k) contribution will reduce your taxable income. We would not recommend contributing any more than the employer match rate as 401(k) plans are very limited and the rest of your income would better serve you elsewhere. Be aware of the fact that you will have to pay a 10% penalty to the IRS if you cash out the 401(k) prior to retirement but the tax shelter provided will serve to offset some of this penalty. With that said, we would suggest that a 401(k) plan is not a very strong part of a retirement plan and that the funds accumulated would probably better serve you as capital to be deployed once you have developed a more specific investment plan. The 401(k) will allow you to automatically put aside a very small amount of income for use once you are farther along on your road to financial freedom. This vehicle may not be suitable for everyone, but it may be useful if you are still working on creating a sound investment or business plan.

3. Develop a plan to eliminate all consumer debt

You must eliminate all consumer debt before you can effectively begin to build wealth and your first target should be credit card debt. The interest rate on your credit card, in all likelihood, will far outweigh any return on investment that you could consistently generate with your money. So develop a plan to pay all credit card debt off as soon as possible. The most effective way to do this is to determine exactly what dollar amount you can afford to pay towards your credit card debt with each paycheck, and to pay that amount immediately as soon as your paycheck is received. Do not leave yourself short on other bills but make sure that you are paying a sizeable chunk of debt down each month at the same time. If you have multiple credit cards then you should pay the card with the highest interest rate off first. Once all credit card debt is eliminated, move on to the next highest interest rate obligation that you have. The one exception to paying down the highest interest rate debt first is if you have a smaller obligation that could be paid off very quickly in order to free up additional cash flow that could then be directed towards the higher interest debt. While eliminating consumer debt may seem like a long and slow process, be patient and persistent. Imagine a world in which you have no consumer debt to pay and imagine how much extra money you will have at your disposal once you are free of consumer debt.

4. Develop a plan to eliminate or reduce mortgage debt

This step could possibly be interchanged with the next steps depending on your situation but the idea is to either eliminate or reduce your monthly mortgage debt significantly now that you have additional free cash flow from eliminating consumer debt. While the many possibilities cannot be described in this article due to the variety and complexity of mortgage types, we do discuss mortgages in more detail here. Broadly speaking, assess your mortgage and determine if an action can be taken to enhance your financial situation (reducing the LTV, refinancing, etc).

5. Build a six month cash reserve

If you have not already built a cash reserve then now is the time to do so (if you have dependents then you may want to consider making this step two). A cash reserve should be extremely liquid so that you have access to the money in a timely manner in case of emergency. A standard checking account would serve this purpose. Interest bearing savings or money market accounts are acceptable choices although you can rest assured that the interest paid on these accounts will be negligible. Cash under the pillow is another option. Gold or silver bullion could be a wise choice but you will probably want to have direct and immediate access to some cash. While six months is a good benchmark, you could consider building a one year cash reserve as well. Just make sure that you are prepared to sustain yourself and meet obligations in case of an emergency.

6. Set up an IBC whole life insurance policy

If you are unfamiliar with the IBC (Infinite Banking Concept) strategy then this step will require some research before you are comfortable with the idea. Now, do not be put off by seeing this recommendation for ‘life insurance’ – learning about an IBC policy will completely shatter your preconceived notions about what life insurance can do. The reason you have not heard about this type of policy before is because Wall Street would go out of business very quickly if the masses learned and implemented this financial strategy. An IBC policy is about building an ever-growing pool of capital in a way that is advantageous in both the tax and liability realms. The IBC strategy is not about death benefits and it is not about rates of return – these are just bonuses.

When structured properly, IBC policies allow you to funnel income into the policy rather than a bank account. Unlike your bank account, your life insurance cash value is secure from creditors, bail-ins, and bank runs. The cash value also generates a small rate of return without sacrificing liquidity – you can access your cash value tax free at any time for any reason. The implementation of this strategy does require a long-term commitment because it will take on average 8-10 years before an IBC policy ‘breaks even’ internally (cash value equals premium outlay).

Please feel free to email us if you would like more information on this concept.

7. Build diversified income streams in fields that interest you

At this point you have done your due diligence and are in a financial position that will allow you to work on pursuing income in ways that are enjoyable to you. If you are already engaged in work that is satisfying and meaningful to you then this step may not be relevant to you. But if you are like most of us who simply tolerate or maybe despise our job then now is the time to make changes. And even if you are content in your current profession it may be wise to build side businesses as economic conditions are tentative at best at this juncture in time.

Start by deciding what it is that you would like to do with your time and then develop a plan to generate income from your chosen field. While this is an embarrassingly simplistic statement, it is entirely possible to generate income from any good or service for which there is a market. Build a big business. Build several small businesses. Buy rental properties. Become a freelancer in your areas of expertise. Whatever your plan is, the important thing is to engage in work that is enjoyable and meaningful to you – income is useless if it comes with the sacrifice of happiness.

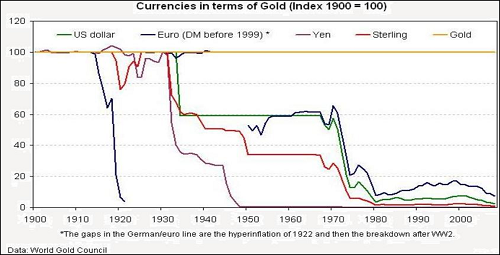

8. Convert income into real assets

Once you have developed a source or sources of stable income then it is time to convert this income into real assets. The most widely accepted choices would be gold and silver bullion, real estate, and/or farm land but you are not limited to these. Real assets could also be things that increase your household’s self sustainability such as alternative energy sources or a family garden. You could also choose more speculative items such as art work or a wine collection but these assets would be much less liquid and thus much more risky (well, the wine would be liquid but in a different kind of way). If you venture into the realm of these speculative investments then make sure that you have a portfolio consisting of the more widely accepted assets as well.

Conclusion:

Note that we wittingly omitted any mention of investing in paper equities (stocks, mutual funds, exchange-traded funds, bonds). The first reason for this is that the financial services industry has sold this type of investment as the only one suitable for retirement which is a lie. There may be a place for this type of investment within your portfolio but it will require much diligence and should serve only as one asset class amongst several within your portfolio. Holding a mixture of stocks across different industries is said by the experts to be the key to diversifying your portfolio. We would suggest that holding a mixture of stocks, real estate, gold and silver bullion, etc. would be the key to a diversified portfolio and that holding only paper equities would be terribly risky. So if you do choose to include equity investments in your portfolio please make sure that you do your research and that you also diversify amongst other, more tangible asset classes as well.

Think of real assets as a ‘backing’ to the cash value of your IBC whole life insurance policy that we discussed in step 6. By building a significant pool of capital (IBC policy) and solidifying it with real assets you are doing exactly what the elite central banks do – except without resorting to fraud. The central banks, Wall Street, and the power elite in general have done a wonderful job of convincing the masses that the key to success is to accumulate exclusively stocks and bonds. And this is true. But what they did not disclose to the masses is that such a strategy is key to the success of the central banks, Wall Street, and the power elite, not the masses themselves.

We hope that this brief article serves as a guide towards maximizing your personal liberty, resiliency, and self-sufficiency.

Always remember that happiness, fulfillment, and calmness of mind and spirit are the most precious of commodities and be mindful not to lose sight of these ideals on the road to building wealth and obtaining self-sufficiency. Also, never be afraid to follow your heart and stand on your principles; this life is but a journey in search of experience and wisdom, and that journey is best undertaken to the beat of one’s own drum.