by Jeff Clark – Hard Assets Alliance:

There’s a subset of investors who see the big picture for gold, believe in the fundamental case, and have the means to buy, but are holding off because they think gold is headed lower. By waiting, they believe they’ll get a better price.

With all due respect to those of you in that camp, I think that’s a mistake.

If one is convinced gold will be cheaper a week or month or quarter from now, it might seem prudent to wait to buy. But obviously no one knows if gold is headed lower or if it’s already bottomed. So don’t kid yourself: you may or may not get a better price.

And premiums don’t stay the same. The US Mint raised the price it charges authorized silver purchasers by a substantial 50¢ after last month’s big retreat. The price retail silver buyers paid was not as attractive as they thought it would be.

But these issues miss the bigger point. Here’s what I think is perhaps a better way to view the subject, along with how to handle the dilemma…

Gold Is Not an Investment—It’s Insurance

“A dollar is worth only 70¢ now,” my dad once told me as we worked in the back yard. “And they say it’ll only be worth 50¢ in a few years.”

It was the mid-1970s. I was helping my dad build a dirt road to our barn, and he wasn’t happy. Not about the hard work or humidity, but from what was happening to the dollar. Inflation was starting to kick into high gear, grabbing headlines that even a girl-chasing teenager could understand.

I remember being appalled by the thought of going to the store and having the clerk demand $1.30 for an item marked $1. Knowing what I know now, my thinking wasn’t that far off.

Our local paper ran a story of a blue-collar worker who had stuffed wads of dollars into the back of his gun cabinet early in his working life. The money was discovered by the family after his death. While saving money is good, the duck-hunter equivalent of “Family Mattress Bank & Trust” won’t keep your money from depreciating; the stash of $10s and $20s had lost over half its purchasing power since he’d hidden it some 30 years earlier.

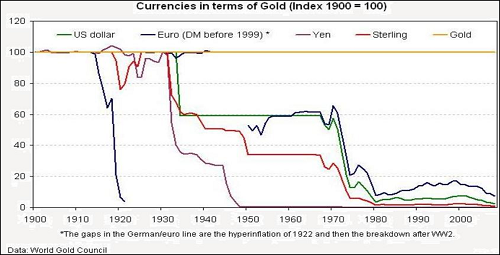

About the same time the gun locker was being lined with legal tender, both of my grandfathers—unbeknownst to me at the time—bought some gold and silver coins for me and likewise stored them away. I inherited them a few years ago—and the purchasing power of the coins is still the same as it was 30 years ago, despite the price fluctuations along the way.

If gold were an investment, it might be prudent to see if you can get a better price. But it’s not. It’s lifestyle insurance. It’s an alternate currency that will withstand the inevitable fallout of government excess, the start of which grows closer by the day. It is purchasing-power protection—protection that you and I may use sooner than we’d like.

You might argue that you always try to get the best price when you buy auto insurance and life insurance. That’s true—but the difference is that you shop among different brokers for the best price; you don’t put off the decision because you read somewhere the insurance industry might lower its rates at some point in the future.

So, what to do?

Don’t “Buy” Gold—Accumulate It

Neither you nor I nor anyone else knows exactly when the very best price for gold will occur. But since it’s an increasingly critical form of insurance in today’s world, the thing to do is to take a portion of your dollars earmarked for gold and buy some now, but keep some powder dry for the next potential dip. That way you’ve got a good price in case the bottom is in, but still have some cash available if the price falls lower. Then buy another tranche next week or next month or next quarter—whatever suits your cash flow and financial plan—but make it a regular occurrence until you have the full allotment you want.

This is exactly how central banks buy.

Central banks aren’t trying to snag the bottom. They’re focused on how many ounces they own.

Further, almost no institutional investor or money manager buys in one lump sum. They accumulate.

Our focus should be the same. Our amounts are a lot less, of course, but the point is to buy in regular tranches, working toward our allocation goal.

I cringe when I hear people say they’re waiting for a better price. What if the market takes off higher or simply stops falling—then what?

Start your accumulation plan today. Heck, you can even use the MetalStream service to buy automatically each month, and the amounts can be adjusted each time if you want. Just log into your Hard Assets Alliance account and once logged in, click the MetalStream signup button to get started.

In a short period, you’ll have a nice stash of hard assets purchased via dollar cost averaging (i.e., at the best cost basis you could hope to achieve).

Whatever you do, start now. Then keep going.

Article originally posted in the December issue of Smart Metals Investor at HardAssetsAlliance.com.