by Peter St. Onge

Article originally published in the March issue of BankNotes.

One of the great debates today between left and right is whether government stimulus is worth it. The left says “yes, early and often.” And the right says “only in the right circumstances.” Unsurprisingly, both left and right are completely off — stimulus is the quickest way to impoverish an economy.

To see why, we’ll start with America’s most famous burglar, Richard Nixon. Nixon is said to have remarked that “We are all Keynesians.” This is probably true; everybody Richard Nixon listened to was “all Keynesians.” And even today nearly every talking head on TV or in major newspapers is “all Keynesians.” Right-wing, left-wing, it’s just a big pile of Keynesians.

This is important when we see “balanced” debates among prestigious economists — “prestige” in mainstream economics is short-hand for “Keynesian.” Future generations may well find this funny, but today this is where we are.

Why does this matter? Because if the Keynesian orthodoxy is ridiculous, say, then all we get is “balanced” flavors of ridiculous.

Why ridiculous? Keynesians’ original sin is that it proposes that spending makes us richer. The other fallacies flow out of that core error. This rich-by-spending doctrine obviously doesn’t work in real life — if you’re poor, the solution is not to borrow money and have a party about it. The solution is to work hard and save up. It’s not rocket science.

Why the appeal? Why are nearly all economists, left and right, Keynesians? The idea that spending makes us richer is a very old one. It’s not original to Keynes, who wasn’t much of an economic or original thinker anyway. Keynes was just regurgitating the age-old fallacy known as “underconsumption.”

“Underconsumption”

Underconsumptionism holds that economies do well when the cash flows. It seems intuitive from the top-down: if people are spending money then times must be good. If they’re not spending money there must be a problem.

Unsurprisingly, this gets it exactly backward. Spending is what happens once you’re rich. It doesn’t actually make you rich. So if an economy is doing well then people do indeed buy more swimming pools. But it’s obviously not the swimming pools

that made them rich.

So what did make them rich? Investment. More specifically, market-led investment. Why the “market-led” part? Because zany bureaucrats define their bridges to nowhere and squirrel-menstruation research as “investment.

Now, it’s not that all government spending is useless — they do build gutters and sewage plants, after all. But we’ve really got no way to know whether some bureaucrat’s “investment” is growing the economy. Hence it’s tempting to say “private investment” is all that matters, but I’ll be open-minded and just

say “market-led.” Meaning that a government that actually did find out market demand (for a bridge from Manhattan to New Jersey, say) would qualify as “market-led” investment and make us wealthier. We can see the role of private investment in the

classic Robinson Crusoe picture. Poor Robinson wakes up hungry, wet, and cold. It rained all night, and he’s picked up a nasty cough. Robinson looks up at the sky, shaking his fist at the Gods of Poverty.

How does Robinson improve his lot? Why, he invests. He builds fishing hooks, fish-nets, berry-shaking sticks. He collects wood, first to build a shelter then to keep a fire going. Investments all.

And over there, in the corner, you can see the Keynesian tsk-tsking, “Why do all that hard work investing when you can just spend more, Robinson?” Remember, these are “prestigious” economists.

So how does this fatal error translate into policy today? The key thing to remember is that when the government increases “spending” it is simply making pieces of paper — known as “dollars.” Not fish hooks. Not firewood. Bidding tickets is what government makes. Why do they do this? Partly to buy votes, of course: if I could print up dollars, I guarantee I’d have a lot of Facebook friends. And partly to “boost” the economy with all that spending.

Fiat Money ≠ Wealth

The problem is, printing tickets isn’t a real resource. You don’t eat paper, as they say. Printing dollars merely bids away resources from other uses.

Let’s say Fed Chair Yellen made an error and printed me up a trillion dollars. Why, I’d use those dollars to buy all — and I do mean all — the beach-front property. I would have the most galactic beach-front party in history. Thing is, Yellen just gave me bidding tickets. She didn’t give me the booze, the DJ’s, the

concrete, or the wood.

So how do I put this party on? Why, I use Yellen’s dollars to bid it all away from you. Yep, you. Building a factory? Too bad: I’ve outbid you for the concrete. Building a back deck? Too bad: it’s my lumber. There’s a party on, didn’t you hear? A Keynesian party.

So is my resource-sucking mega-party making the economy grow? Nope. When it’s all over, when the hangovers along with the ear-ringing subsides are gone, we’ve used real resources. We’ve got no factories. No decks. We’re all poorer. But the politicians did get re-elected, right?

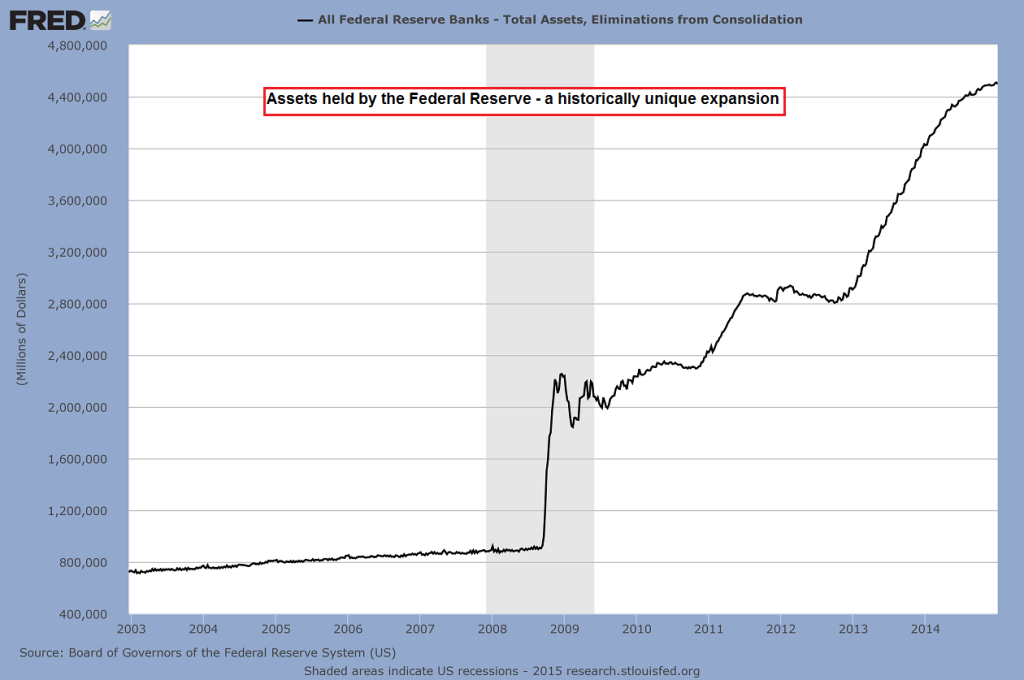

This, in a nutshell, is Keynesian “stimulus.” Whether it comes from government spending (“fiscal stimulus”) or from Federal Reserve money-printing (monetary stimulus). In either case, real resources were bid away from the rest of us and handed out to others.

Stimulus isn’t some magical leprechaun dropping ice cream and puppies from heaven — it’s merely redistribution of resources. Stimulus is taking from those who have and giving to the government’s pals.

So the question “does stimulus work?” is completely missing the point. Putting aside the injustice of redistributive theft, the productivity question is whether the guys who got the bidding tickets did more market-led investment than the guys whose tickets were devalued.

There is no economic reason to think mere redistribution would make us richer. In fact, there are excellent reasons that show redistribution hurts the economy. “Stimulus” itself is nothing more than widespread impoverishment so a clutch of politicians can buy friends.

Please see the March issue of BankNotes for the original article and others like it.