submitted by jwithrow.

“The process [of debauching the currency] engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.” – John Maynard Keynes

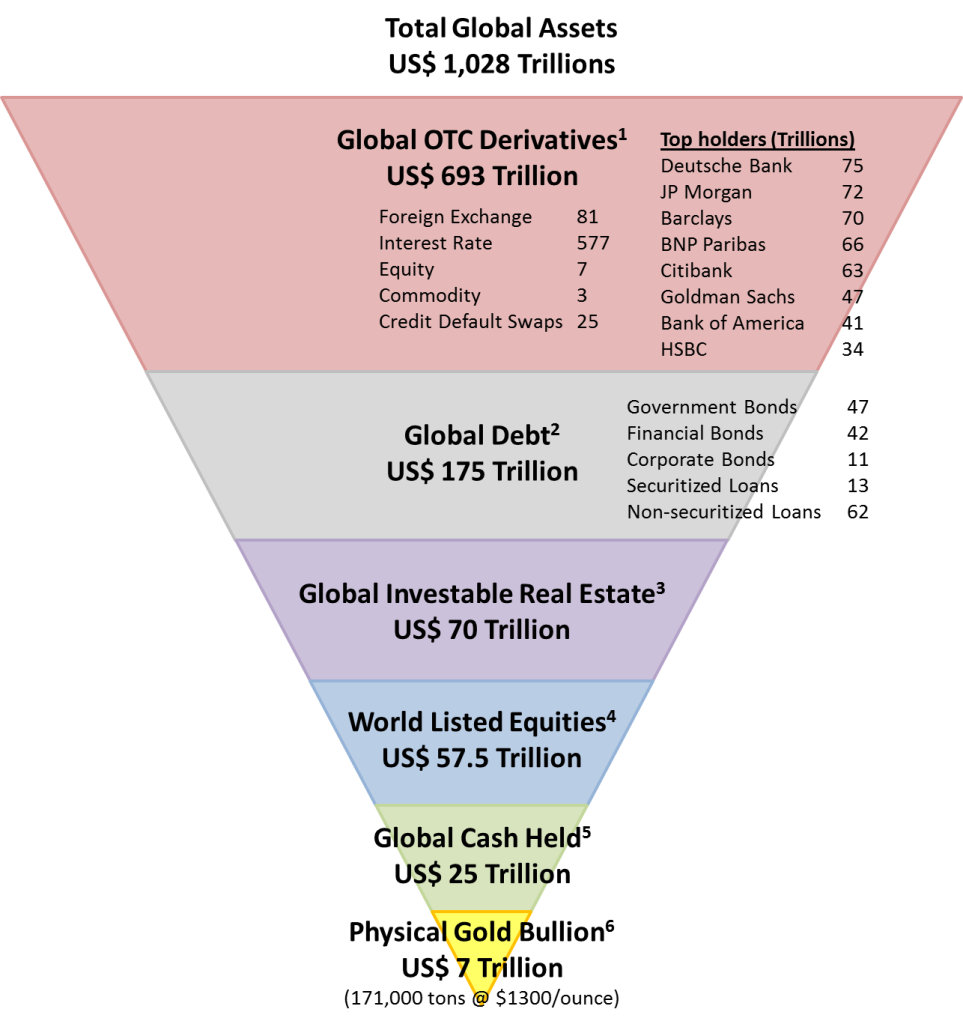

This chart illustrates the construct of the global financial system denominated in U.S. dollars.

There is an estimated 171,000 tons of physical gold bullion currently in existence which is $7 trillion if priced at $1,300 per ounce. Physical gold served the global financial system as an anchor in some capacity from the Industrial Revolution all the way up until 1971.

The U.S. dollar became the sole anchor of the international monetary system in 1971 and there is now approximately $25 trillion sitting in cash globally. Additionally, global equity markets are valued at roughly $57.5 trillion and global investable real estate valuations are roughly $70 trillion.

Global debt has reached $175 trillion with governments being the biggest debtors. This number does not include all of the unfunded liabilities accrued by the social welfare states of the world.

Dwarfing all other U.S. dollar denominated asset classes is the over-the-counter derivatives market. According to the BIS, OTC derivatives total $639 trillion with interest rate derivatives being the largest category by far.

So there is approximately $1,028 trillion worth of U.S. dollar denominated global assets in existence and physical gold, the market’s choice for money over several centuries, makes up less than 1% of total global assets.

Gold is the only asset on this chart that has no counterparty risk meaning there are no other contractual parties involved when you hold physical gold.

The U.S. dollar is issued and managed by the Federal Reserve and the Fed can (and does) reduce the value of the dollar simply by creating more dollars. Equity values obviously depend on the particular company’s financial performance. Real estate investments depend on a tenant to make payments in a timely fashion. The counterparty to debt is the debtor who must make timely payments and the debtor typically has counterparties as well. Derivatives, the largest global asset class, come with a complex web of counterparties that are virtually impossible to predict.

Global dollar denominated assets have been able to balloon up to $1,028 almost exclusively because of 40+ years of constant credit and credit-based money expansion. One day credit will have to contract and that $1,028 trillion figure will dissipate rather quickly. Where do you think capital will fly to when that day comes?

My bet is physical gold.

Image Source: Global Precious Metals