submitted by jwithrow.

Journal of a Wayward Philosopher

The Coming College Collapse

March 19, 2015

Hot Springs, VA

The S&P opened at $2,093 today. Gold is checking in at $1,166 per ounce. Oil is floating around $46 per barrel. Bitcoin is down to $262 per BTC, and the 10-year Treasury rate opened at 1.94% today.

Big news this month… two colleges died! Sweet Briar College in rural Virginia recently announced its own funeral scheduled for the end of the 2014-2015 academic year. Tennessee Temple University in Chattanooga also pronounced its coming death scheduled for May 1, 2015.

Sweet Briar is a small liberal arts women’s college with less than 750 students and Tennessee Temple is a small Christian university with less than 500 students so these are certainly niche schools that faced challenges not yet encountered by their larger peers. I think it would be unwise to dismiss these closures at outliers, however. Instead, this may be foreshadowing the coming student loan bubble collapse and the growing obsolescence of traditional higher education. Beware bubble, the needle approacheth.

Indeed, the Obama administration is now pushing a “student aid bill of rights” chock full of government regulations, controls, and oversight… what could be a better sign of the impending college collapse than that? And the federal government already finances or guarantees ninety-some percent of all student loans as it is.

College is still the holy grail of success in many American minds but that sentiment is gradually changing. Colleges, in most cases (specialized fields of study being the exception), are little more than glorified diploma mills. Everyone goes to college primarily to receive a degree that is seen as a ‘certification’ of sorts to work a corporate job. That’s why college graduates list their degree at the top of their resume and they mention it first thing in job interviews – having a degree demonstrates that they are qualified to hold a job.

So the system works like this:

1. Kids are told to get good grades in high school so they can get into college.

2. As high school graduation approaches, kids are hustled through the college application process. They are encouraged to apply early to as many schools as possible to give themselves the best chance of getting in. Critical thinking and introspection can wait.

3. Once accepted into college, the kids are walked through the student loan process. It is understood that they don’t have enough money to pay for tuition so someone else must lend it to them. And that someone else is probably the federal government.

4. Colleges raise tuition each year because the federal government is willing to finance or guarantee nearly all student loans sans sound underwriting guidelines.

5. Students apply for new student loans at the higher tuition rate for each subsequent year in college.

6. Students graduate with massive student loan debt and face a competitive job market because nearly all of their peers have a bachelor’s degree as well.

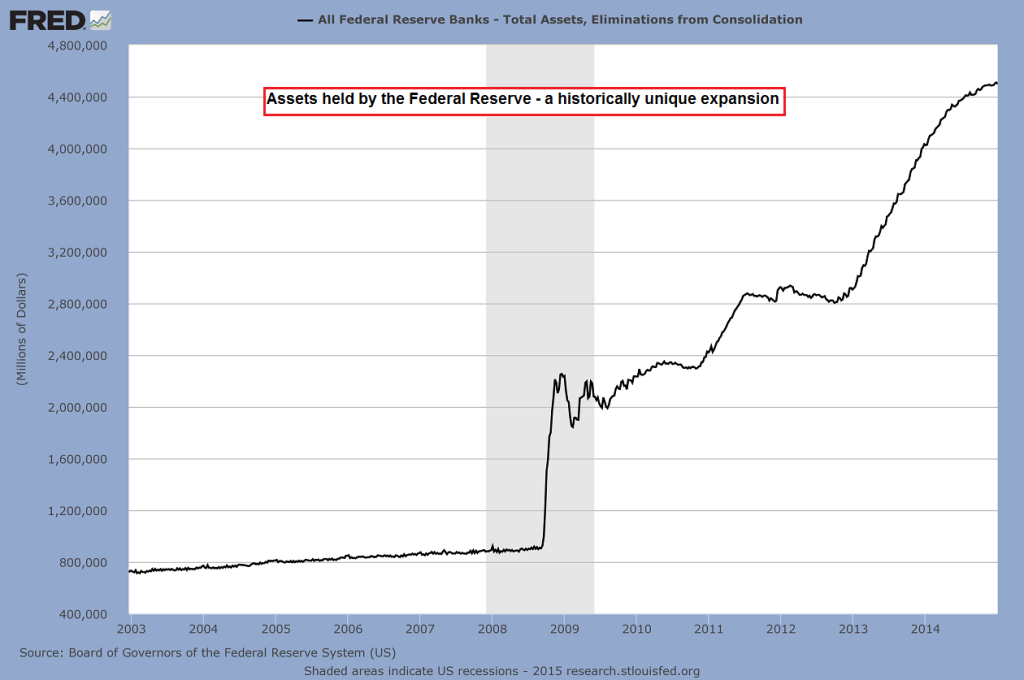

As you can see, the student loan racket is perpetuated by cheap money supplied by the Feds. The only reason colleges can raise tuitions significantly each and every year is because a very large percentage of the population attends college. The only reason a very large percentage of the population attends college is because the Feds supply them with cheap money to do so with few questions asked.

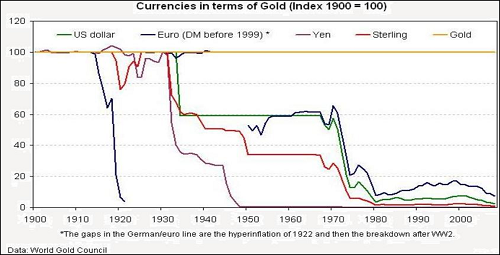

But there’s a catch. When we talk about this cheap “money” supplied by the Feds we are really talking about credit. This credit is created ex nihilo (out of nothing) – it only exists as an electronic record on a computer network somewhere in the “cloud”. Unlike real money, credit can vanish just as quickly as it appeared in the first place. You can’t put it in a safe. You can’t put it under your mattress for a rainy day. Credit is intangible.

The current model of higher education depends on constant credit expansion. Students don’t pay for college up front; they finance it as they go by obtaining multiple loans over time. Their continued enrollment depends upon their ability to get the next loan. It is assumed by pretty much everyone – parents, students, guidance counselors, professors, university presidents, Wall Street CEOs, government officials – that this system of constant credit expansion can continue into the future.

The word credit is derived from the Latin credere which means “to believe”. Credit depends on trust; it’s all a confidence game. And we are starting to see the trust in American higher education teeter. This trust will continue to degenerate as student loan debt continues to pile up and the job market continues to be flooded with bachelor’s degrees. This process is accentuated by the mountain of debt being accumulated by the federal government – the same group that finances the student loan bubble.

When the trust disappears, so does the credit… probably to the tune of trillions of dollars overnight. What happens then? Common sense suggests that colleges would be forced to reduce tuition drastically if students actually had to pay for college themselves. But have you been to a college campus recently? The campuses are pristine, the buildings are luxurious, and the amenities are plentiful. Have you looked at your alma mater’s annual financial statements recently? What does its long-term debt look like? How about its pension liabilities?

The fact is most American colleges would be insolvent if it weren’t for the Fed’s exponential credit expansion. If you think the credit can expand forever then this fact doesn’t really matter. But if you think the credit will eventually dry up then we are likely to see many more Sweet Briars and Tennessee Temple’s to come.

So do not despair, dear Vixens and Crusaders, you will not be the only alma mater-less Americans for long.

Until the morrow,

Joe Withrow

Wayward Philosopher

For more of Joe’s thoughts on the “Great Reset” and the paradigm shift currently in motion please read “The Individual is Rising” which is available at http://www.theindividualisrising.com/. The book is also available on Amazon in both paperback and Kindle editions.