submitted by jwithrow.

Journal of a Wayward Philosopher

Fiat Money Undermines Society

October 14, 2014

Hot Springs, VA

The S&P is checking in at $1,878 today, gold is up to $1,234, oil is down to $85, bitcoin is up to $403, and the 10-year is now down to 2.20%. All in a day’s work, I suppose.

Autumn is truly a beautiful season. There is a gentle, crisp breeze in the air up here in the mountains of Virginia and a myriad of red, orange, and yellow leaves dot the landscape. As we await Maddie’s entrance, wife Rachel and I will spend the day making homemade apple cider to celebrate such a fine season!

Last week I suggested that fiat money always seems to undermine the morality and stability of society throughout history. Let’s examine this a little bit more today.

First, we must be clear about what fiat money is. Fiat money is any currency that derives its value from government law and regulation. The word ‘fiat’ is Latin for “let it be done”. Essentially, fiat money is what the government says is money. Once decreeing something as money, governments usually force people and businesses to use whatever it is through legal tender laws. Fiat money has taken different forms throughout history. Today we primarily use electronic credit-based national currencies (U.S. dollars, Euros, Yen, etc.) as our fiat money. We still use fiat paper currency also but we are gradually transitioning away from this form of money. Here in the United States we use “Federal Reserve Notes” as our paper currency. Take a look at what the bills in your wallet say to confirm this.

Societies, to the extent that you can pinpoint a beginning and end to them, have not started out with fiat money. Historically, society starts out with free-market money – usually gold, silver, or some other valuable commodity – and then unwittingly moves to fiat money as its government becomes more and more corrupt.

Rome was using a pure silver “denarius” at the beginning of the 1st century, A.D. Roman emperors then learned how to ‘print’ money by melting down their silver coins, adding cheap base metal into the mix, then re-minting the denarius with a lower silver content. This enabled them to mint more silver coins than they had melted down, but the denarius was no longer pure silver.

The denarius was 85% silver by the year 100. By 218, the denarius was down to only 43% silver content. And by year 244 the denarius contained only .05% silver. This meant that each Roman denarius coin could purchase 99.95% less than what it could originally purchase! In other words, everyday prices were 99.95% higher for Romans in year 244 than they were in year 1.

So why in the world did the Roman emperors debase their currency so much? Why, for great wars, great public works, and to enrich themselves, of course! You have read all about the Roman Empire in the history textbooks. Maintaining an empire requires soldiers and soldiers require food, water, and payment. Oh, and weapons. This gets more and more expensive as the empire gets bigger and bigger. I bet you have read about the coliseum too – it was very expensive to build and maintain. Who was going to pay for it all?

The emperor certainly wasn’t about to curtail his lavish lifestyle to chip in. Instead he turned to dishonest fiat money: he melted down silver coins and made more of them with a lesser silver content. Then he paid the soldiers and workers and pretended like nothing was different about the money. As the currency was debased, Roman society got poorer and the government became more corrupt. Eventually the Roman Empire became impoverished and collapsed.

Looking farther east, Marco Polo documented the use of fiat money in China:

“You might say that [Kublai] has the secret of alchemy in perfection… the Khan causes every year to be made such a vast quantity of this money, which costs him nothing, that it must equal in amount all the treasure of the world.”

He continues:

“Population and trade had greatly increased, but the emissions of paper notes were suffered to largely outrun both… All the beneficial effects of a currency that is allowed to expand with a growth of population and trade were now turned into those evil effects that flow from a currency emitted in excess of such growth. These effects were not slow to develop themselves… The best families in the empire were ruined, a new set of men came into the control of public affairs, and the country became the scene of internecine warfare and confusion.”

The same thing happened in France when John Law introduced fiat paper currency in 1716: the currency was inflated into oblivion and the society was impoverished. And in Weimar Germany in the 1920’s – it got to the point where Germans were using paper marks to heat their furnaces! Argentina has followed suit a couple times in the late 1900’s. Zimbabwe was one of the wealthiest countries in Africa until its government ramped up the printing presses in 2008 and implemented price controls. It wasn’t long before civilized society was wiped out in Zimbabwe and people could no longer get enough food and water for themselves.

Do you notice a trend?

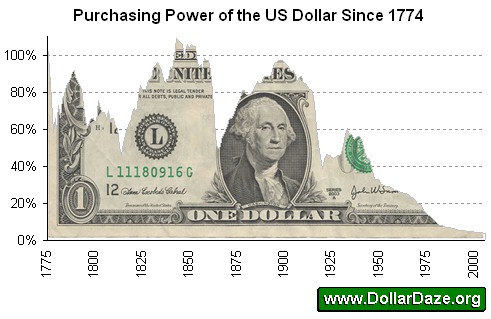

Fast forward to present day: the U.S. dollar has lost 98% of its value since the Federal Reserve was implemented in 1913. Much of this devaluation has occurred since all ties to gold were removed in 1971. What has happened to our cost of living?

Technology has also boomed since 1971 such that the means of production and distribution are much more efficient today than ever before. It seems to me this scenario should have reduced the cost of living for everyone. But has it? It wasn’t that long ago when an average American household consisted of only one wage earner. This one income was enough to provide a high quality of life for the family while the spouse stayed home to raise the kids. Most households now require two incomes just to get by.

The American standard of living is going in the wrong direction and this is largely due to fiat money. Further, the fiat money is used primarily for the same things it has always been used for throughout history – war, public works, and the enrichment of the political class…

I will leave it there for today but I hope my point was made.

Until the morrow,

Joe Withrow

Wayward Philosopher

For more of Joe’s thoughts on the Great Reset and regaining individual sovereignty please read “The Individual is Rising” which is available at http://www.theindividualisrising.com. The book is also available on Amazon in both paperback and Kindle editions.